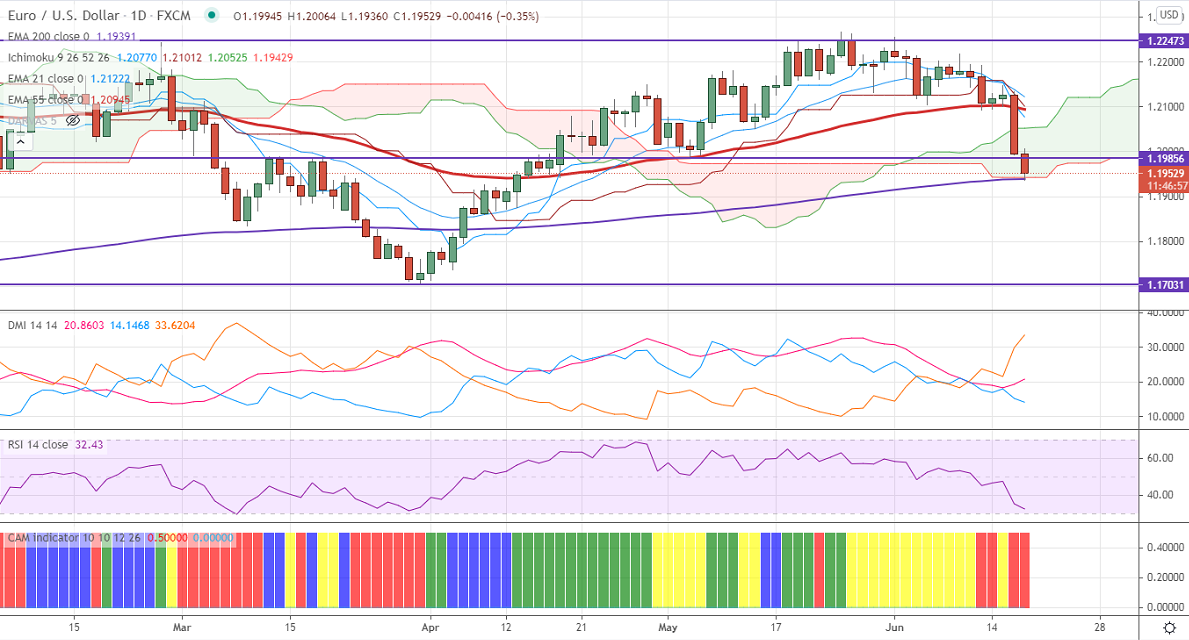

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.21052

Kijun-Sen- 1.21294

EURUSD has declined drastically after the hawkish Fed monetary policy. The central bank has kept its rates unchanged and upgraded its growth and inflation outlook. The Fed dot plot shows that there will be two rate hikes in 2023. The tapering of bond-buying and rate hike sooner than expected has supported the US dollar The US 10-year bond yield surged more than 10% after the monetary policy. DXY is holding above 91.50 levels. Any surge past 91.86 confirms further bullishness. EURUSD hits 1.19425 lowest level since Apr 2021 and is currently trading around 1.19522.

Technical:

On the higher side, near-term resistance is around 1.2020, and any convincing breach above will take the pair to next level 1.2060/1.2100/1.2150. The pair's near-term support is around 1.19390 (200-day EMA), break below targets 1.1900/1.1860.

Indicator (Daily chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 1.1990 with SL around 1.2040 for the TP of 1.18670.