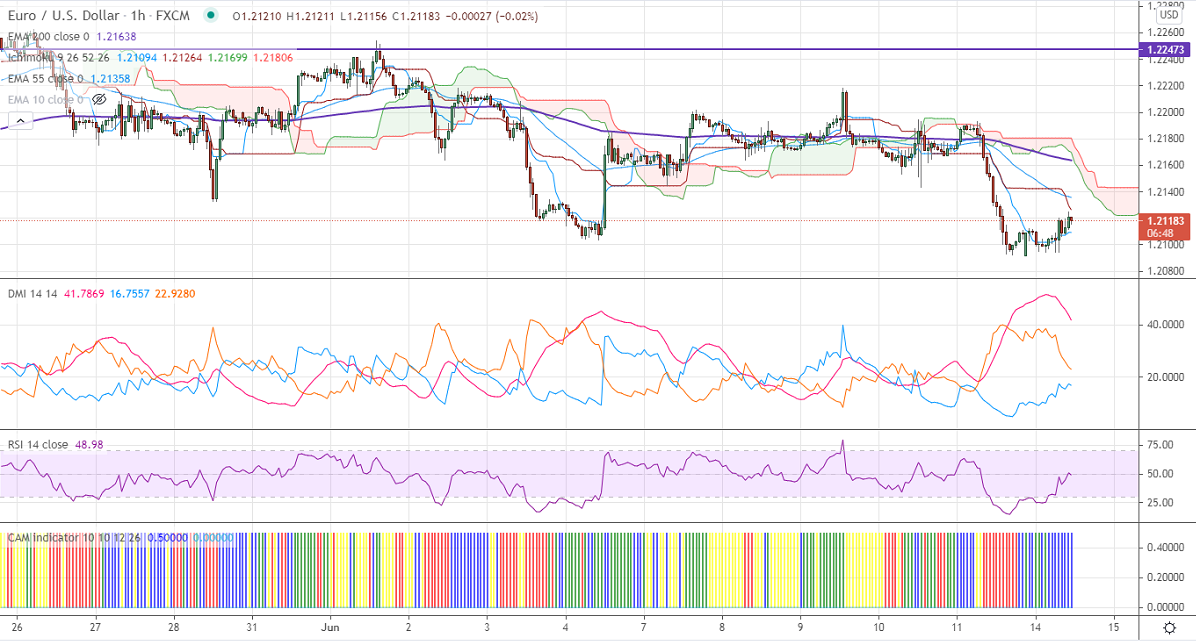

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.21094

Kijun-Sen- 1.21295

EURUSD has halted its three days of losing streak and shown a minor pullback. The pair declined drastically from a high of 1.22180 after upbeat US inflation. Markets eye Fed monetary policy and Chairman speech for further direction. The US-10 year bond yield has recovered some of its loss and jumped more than 3% from its low of 1.428%. DXY is holding above 90 levels. Any surge past 90.60 confirms further bullishness. EURUSD hits an intraday high of 1.21547 and is currently trading around 1.21180.

Technical:

On the higher side, near-term resistance is around 1.21550, and any convincing breach above will take the pair to next level 1.2200/1.2260/1.2300/1.23485. The pair's near-term support is around 1.2090/1.20400 (100-day MA).

Indicator (1-hour chart)

CAM indicator- Slightly bullish

Directional movement index –Neutral

It is good to sell on rallies around 1.21580-60 with SL around 1.2200 for the TP of 1.2050.