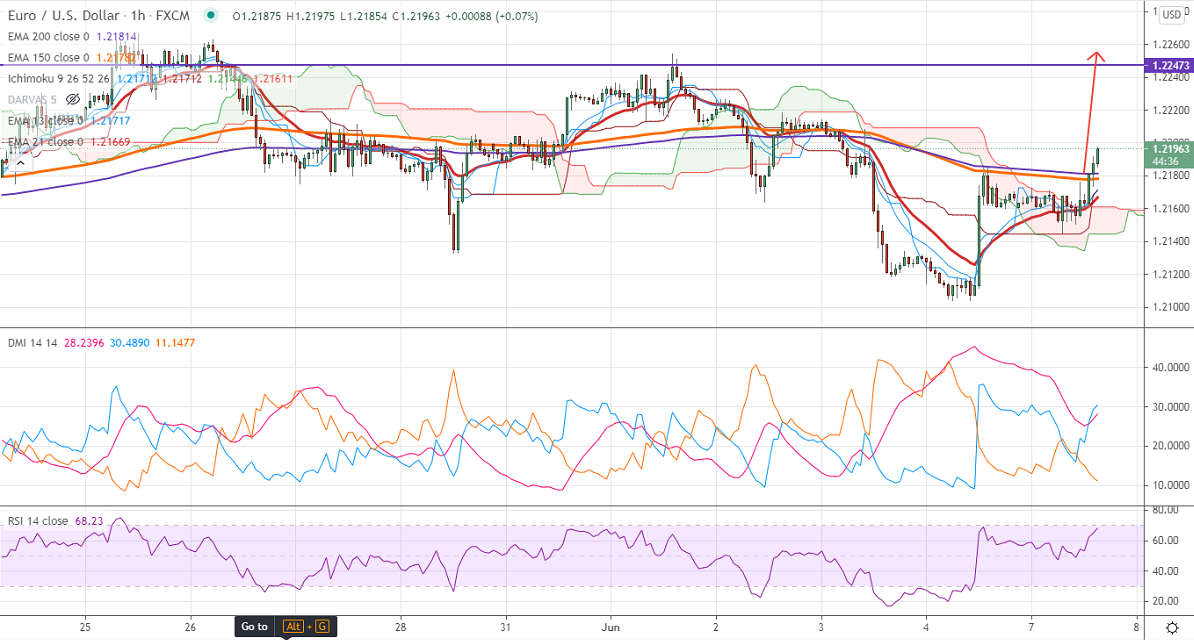

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.21684

Kijun-Sen- 1.21684

EURUSD gained more than 70- pips after forming a minor bottom around 1.21039. The weak US Nonfarm payroll data is supporting the pair at lower levels. The US 10-year bond yield lost more than 5% to 1.55% after the data. DXY declined sharply from a high of 90.62. Any violation below 90 confirms further weakness. EURUSD hits an intraday high of 1.21817 and is currently trading around 1.21678.

Technical:

On the higher side, near-term resistance is around 1.2220, and any convincing breach above will take the pair to next level 1.2260/1.2300/1.23485. The pair's near-term support is around 1.2150, violation below that level targets 1.2100/1.20380 (100- day MA)/1.1980.

Indicator (1-hour chart)

RSI- Bullish

Directional movement index –Bullish

It is good to buy on dips around 1.2185-88 with SL around 1.2150 for the TP of 1.2280.