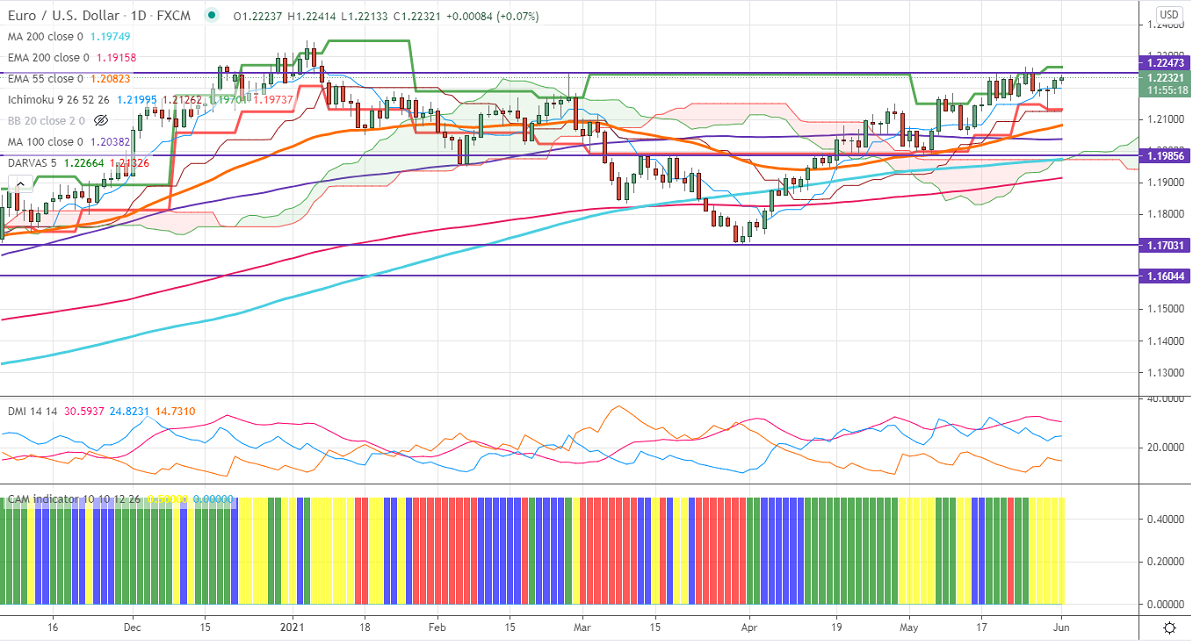

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.21984

Kijun-Sen- 1.21262

EURUSD is holding well above 1.220 levels on upbeat Eurozone PMI data. The German Markit's PMI rose to 64.4 in May compared to a forecast of 64. While Euro zones jumped to 63.1 in May slightly above estimate 62.8. DXY is holding well below 90 levels; any breach below 89.20 confirms short-term weakness. Markets eye US ISM manufacturing PMI and construction spending data for further direction. EURUSD hits an intraday high of 1.22414 and is currently trading around 1.22305.

Technical:

On the higher side, near-term resistance is around 1.22665, and any convincing breach above will take the pair to next level 1.2300/1.23485. The pair's near-term support is around 1.2120, violation below that level targets 1.2070/1.2040 (100- day MA)/1.1980.

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index –Bullish

It is good to buy on dips an around 1.21800-825 with SL around 1.2130 for the TP of 1.2300.