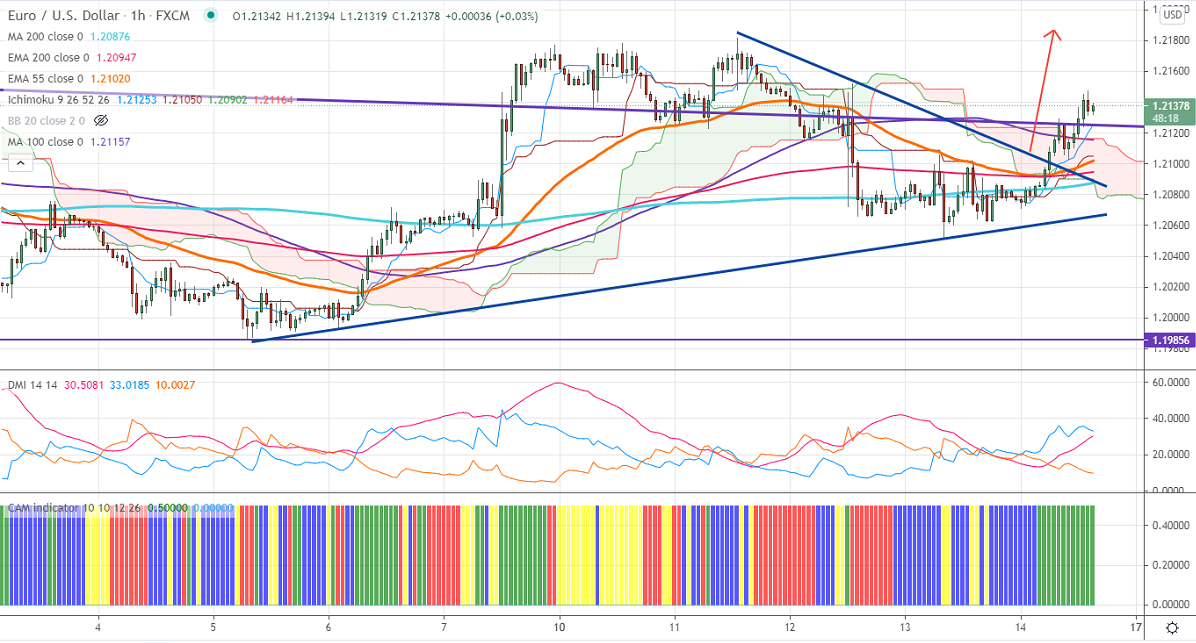

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.21202

Kijun-Sen- 1.21050

EURUSD has regained slightly after weak US retail sales. It came unchanged at 0.0% in Apr compared to a huge jump of 10.7% the previous month. The core retail sales dropped to -0.8% vs an estimate of -0.5%. The US 10-year bond yield declined more than 4.5% from yesterday's high of 1.705%. The University of Michigan consumer sentiment for Apr came at 82.8 much lower than the forecast of 90. DXY is trading lower. Any weakness only below 90 levels.

Technical:

On the higher side, near-term resistance is around 1.2150, and any breach above will take the pair to next level 1.2180/1.2260/1.2300. The pair's near-term support is around 1.2070 (daily low), violation below that level targets 1.2045 (100- day MA)/1.1980. The pair is holding above 100-day MA and trend reversal can happen if it closes below that level.

Indicator (Hourly chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 1.2100 with SL around 1.2050 for the TP of 1.2260.