Ichimoku analysis (1-Hour chart)

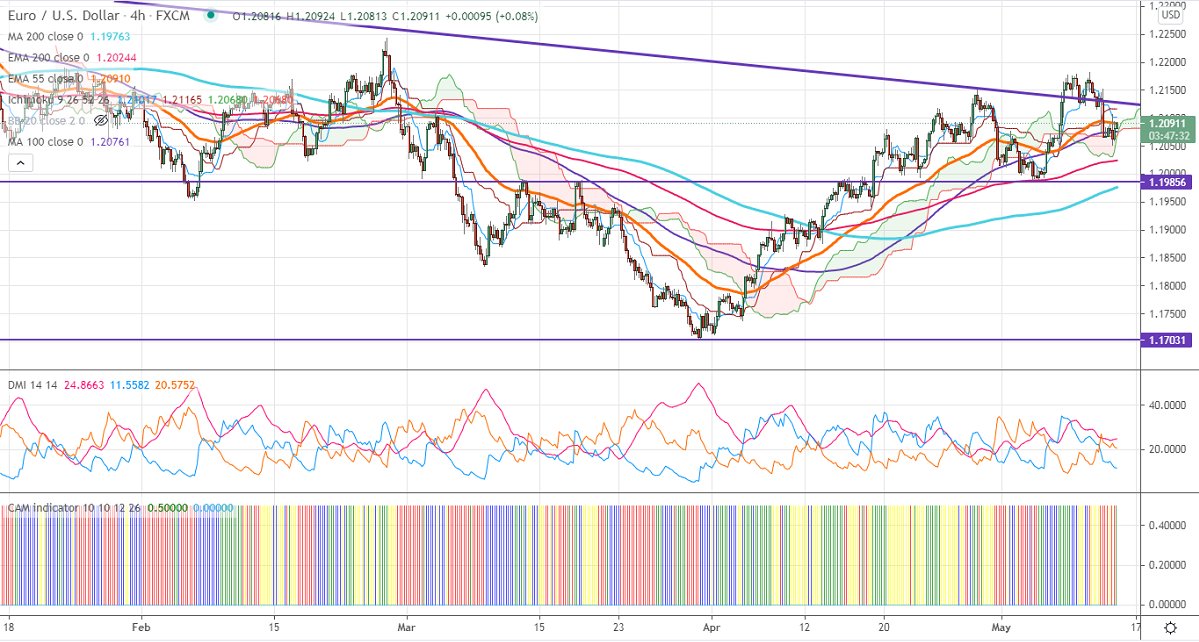

Tenken-Sen- 1.21127

Kijun-Sen- 1.21269

EURUSD jumped from an intraday low of 1.20513 today despite upbeat US PPI data. The US Producer price index rose to 0.6% in Apr compared to a forecast of 0.3%. The annual inflation jumped to 6.2% vs an estimate of 3.8%. The number of people who have applied for unemployment benefits declined to 473000 in the week ended May 8th vs 490000 expected.

DXY is struggling to break above 200-H MA at 90.80. A jump till 91.20 likely.

Technical:

On the higher side, near-term resistance is around 1.2150, and any breach above will take the pair to next level 1.2180/1.2260/1.2300. The pair's near-term support is around 1.2070 (daily low), violation below that level targets 1.2045 (100- day MA)/1.1980.

Indicator (Hourly chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to sell on rallies around 1.2118-20 with SL around 1.21650 for the TP of 1.1980.