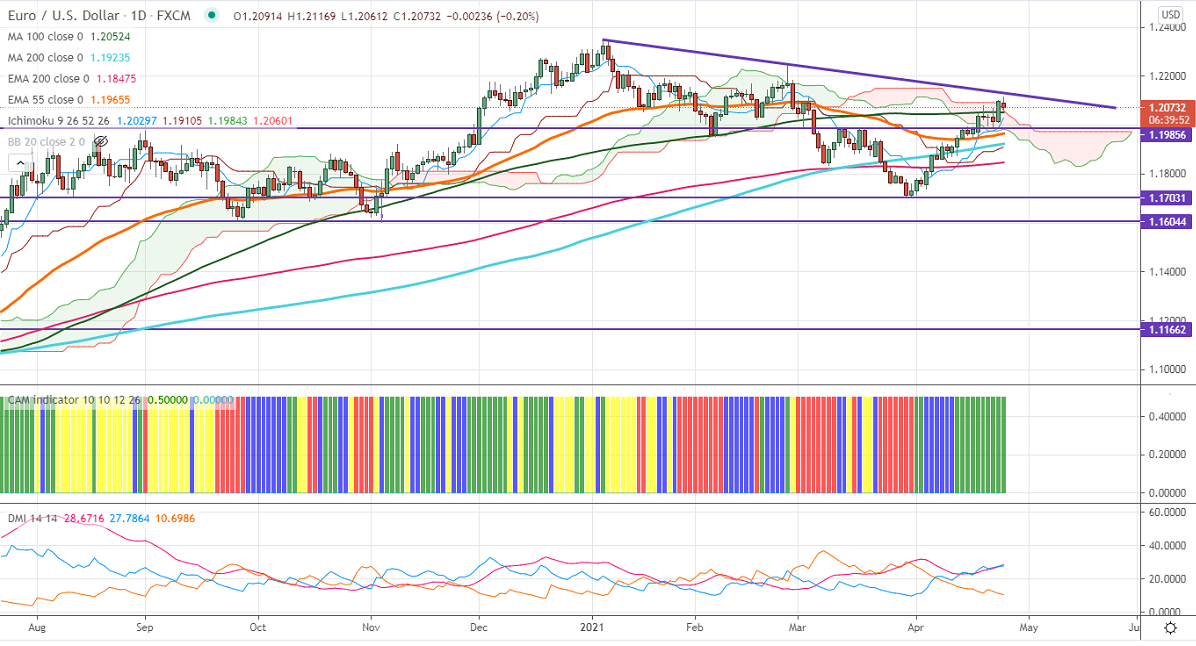

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.19883

Kijun-Sen- 1.19021

EURUSD has lost more than 50 pips from a high of 1.21169 despite weak US economic data. US durable goods orders for March rose by 0.5% much below expectations of 2.5%. New orders for nondefense capital excluding aircraft rose by 0.9% compared to a -0.8% decline the previous month. The German Apr IFO business climate contracted to 98.7 from 99.70. DXY has shown a minor pullback from a low of 90.68, further bullishness only above 91.30. EURUSD hits an intraday high of 1.20612 and is currently trading around 1.20694.

Technical:

The pair's upside is capped by trend line resistance around 1.2130 level. Any violation above that level will take the EURUSD to next level 1.2180/1.2250. On the lower side, near-term support is around 1.2050 (100- day MA), and any indicative breach below targets 1.19980/1.1950/1.1900.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.2040 with SL around 1.1990 for the TP of 1.2150.