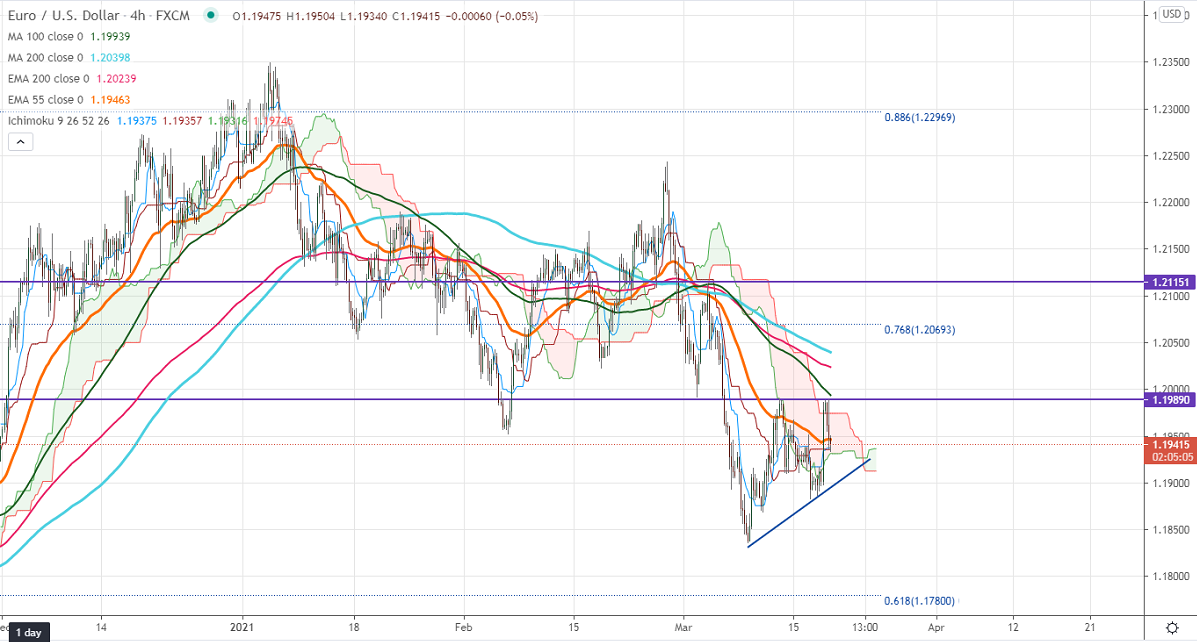

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.19375

Kijun-Sen- 1.19357

EURUSD has surged to 1.9898 on the dovish Fed statement. The Fed's dot plot shows that the rate hike is projected only in 2024. The Central bank has kept its rates unchanged and upgraded US GDP, PCE for 2021. The US 10- year yield hits a fresh h13- year high at 1.744% is supporting the US dollar. DXY recovered slightly after hitting a low of 91.30. The intraday bullishness only if it breaks 92. EURUSD hits an intraday low of 1.19352 and is currently trading around 1.19386.

Technical:

The pair is facing strong support at 1.18800. Any break below confirms minor bearishness, a dip till 1.1835/1.1800 likely. The near-term resistance is around 1.12000. An indicative breach above will take the pair to next level till 1.20400 (200- 4H MA)/1.20870. Short-term trend reversal only above 1.2260.

Indicator (1 Hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1958-60 with SL around 1.2000 for the TP of 1.1830.