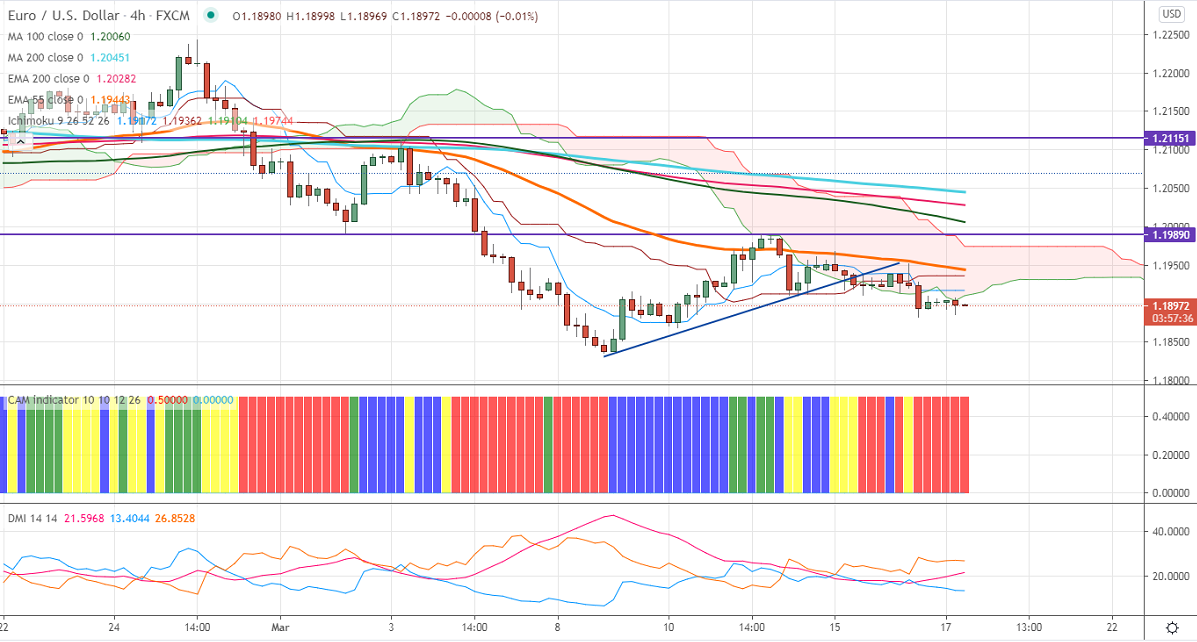

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 1.19172

Kijun-Sen- 1.19362

EURUSD is trading in a narrow range between 1.19884 and 1.18826 ahead of US Fed monetary policy. The central bank is expected to keep interest rates on hold until late 2022. Markets eye Central bank's new forecast for inflation, growth, and employment and Chairman Powell press conference for further direction. US retail sales dropped by 3% in Feb compared to a forecast of -0.5. The January data was revised to 7.6% from 5.3% as previously reported.

DXY is consolidating in a narrow range between 91.965 and 91.67 for the past two days. The intraday bullishness only if it breaks 92. EURUSD hits an intraday low of 1.18863 and is currently trading around 1.18993.

Technical:

The pair is facing strong support at 1.18800. Any break below confirms minor bearishness, a dip till 1.1835/1.1800 likely. The near-term resistance is around 1.1960. An indicative breach above will take the pair to next level till 1.2000/1.2035/1.20500 (200- 4H MA). Short-term trend reversal only above 1.2260.

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1928-30 with SL around 1.1985 for the TP of 1.18300.