Candlestick pattern- Shooting star

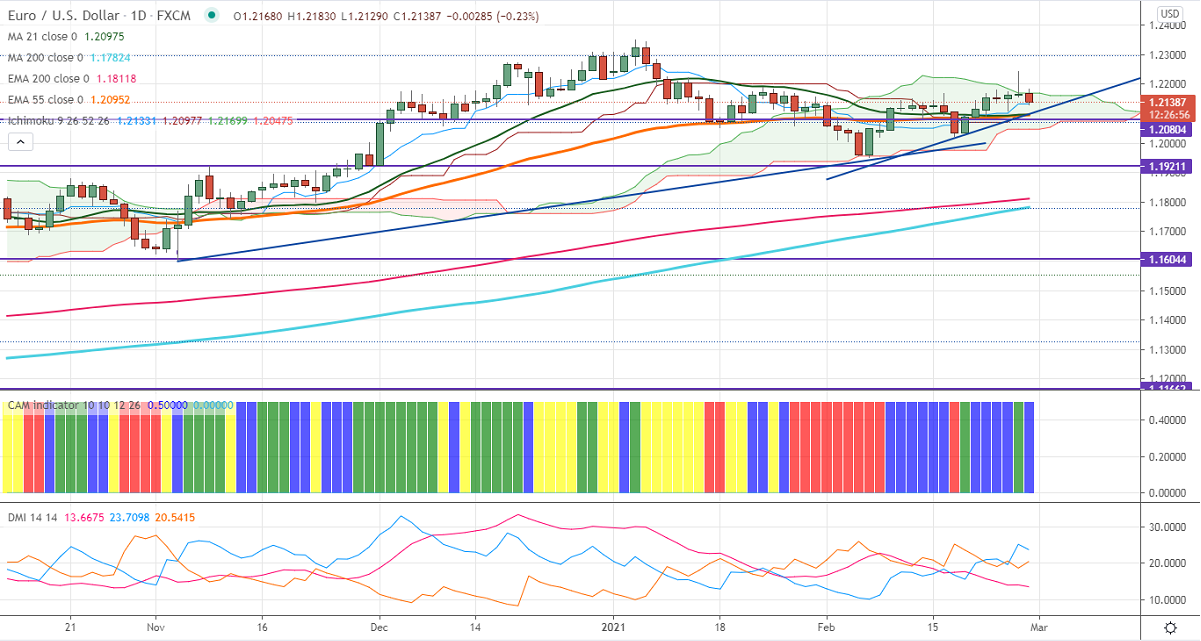

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.21332

Kijun-Sen- 1.20977

EURUSD lost more than 80 pips from minor top 1.2247 on broad-based US dollar buying. The surge in US 10- year yield is supporting the US dollar at lower levels. The yield hits fresh year 1.56% on hopes of massive fiscal stimulus in the U.S to counter Coronavirus. US Q4 GDP surged to 4.1% compared to a forecast of 4.2%. The number of people who have filed for unemployment benefits declined to 730k in the week ended Feb 20th vs an estimate of 828k. EURUSD hits an Intraday low of 1.21290 and is currently trading around 1.21377.

Technical:

The pair is facing strong support at 1.21290. Any break below confirms minor bearishness, a dip till 1.2090/1.2060/1.2020 likely. The near-term resistance is around 1.2180. Breach below will drag the pair up till 1.2200/1.2260.

Indicator (60 min chart)

CAM indicator – neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.2158-60 with SL around 1.2300 for the TP of 1.2025.