Candlestick - Shooting Star (Daily chart)

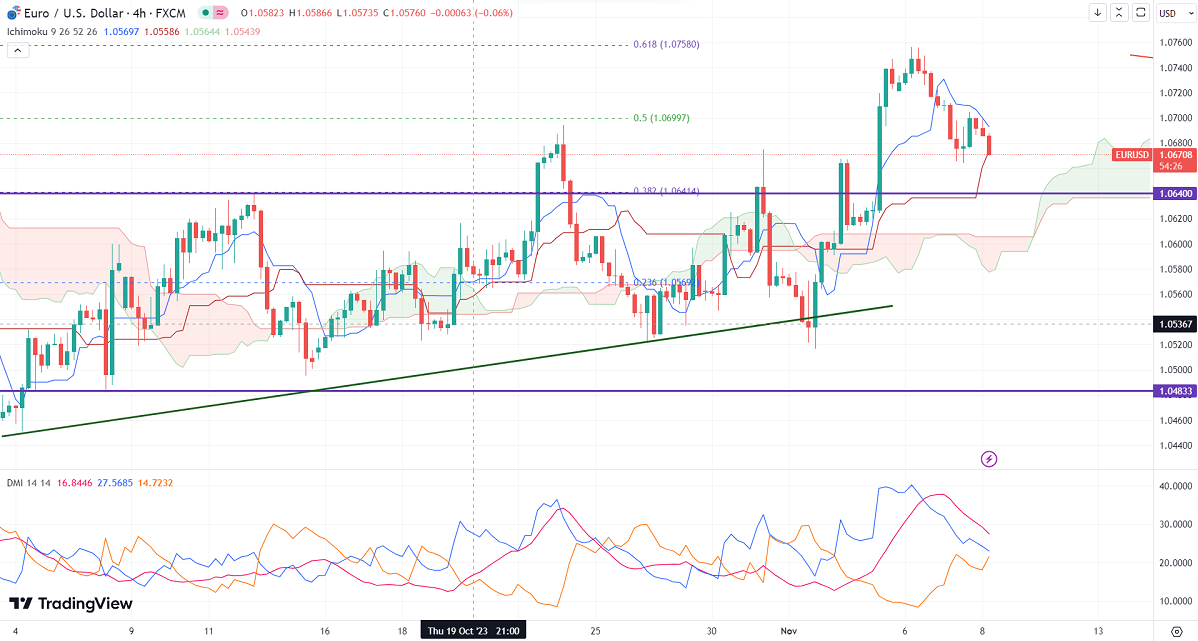

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.07005

Kijun-Sen- 1.06604

EURUSD pares some of its gains on a cautious mood. It hit a low of 16640 yesterday and is currently trading around 1.06755.

Major Economic data for the day

Nov 8th, 2023, Fed Chair Powell Speaks (2:15 pm GMT)

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 90.4% from 68.90% a week ago.

The US 10-year yield pared its gains made yesterday ahead of Fed Powell's speech. The US 10 and 2-year spread widened to -35% from -16%.

The pair trades below short-term 21 EMA, above 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any break below 1.0660 confirms further bearishness. A decline to 1.0600/1.0550 is possible. The near-term resistance is around 1.0720 and any breach above targets is 1.0765/1.0835. Bullish invalidation only if it breaks below 1.0440.

Indicator (4-hour chart)

CCI – bullish

Directional movement index – neutral

It is good to sell on rallies around 1.0700-025 with SL around 1.0760 for a TP of 1.0440.