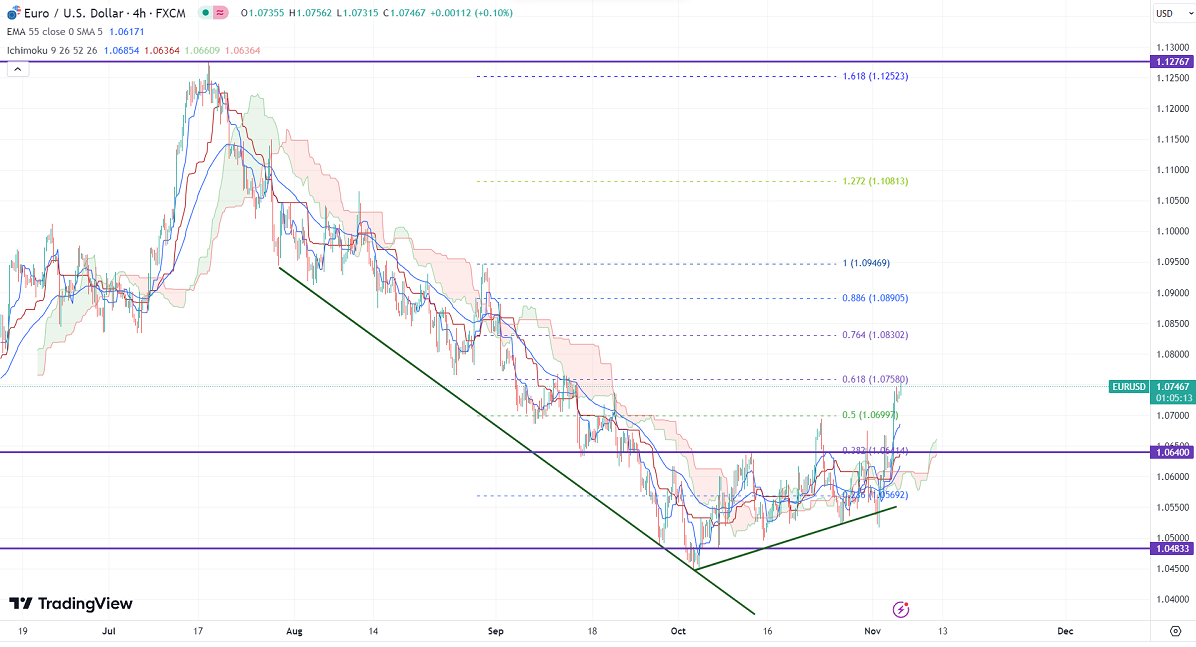

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.06802

Kijun-Sen- 1.06316

EURUSD recovers sharply after weak US jobs data. It hit a high of 1.07562 at the time of writing and is currently trading around 1.07450.

The US economy has added 150000 jobs in Oct compared to a forecast of 180000. Unemployment jumped to 3.9% vs. a Forecast of 3.8%.

Major Economic data for the week

Nov 8th, 2023, Fed Chair Powell Speaks (2:15 pm GMT)

Nov 10 th 2023, Prelim UoM consumer sentiment (3:00 pm GMT)

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 90.2% from 79.10% a week ago.

The US 10-year yield declined more than 7% the previous week in hopes of a rate pause this year. The US 10 and 2-year spread widened to -27 from -22%.

The pair trades above short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any break above 1.0760 confirms further bullishness. A jump to 1.0800/1.0830/1.09450 is possible. The near-term support is around 1.0680 and any breach below targets is 1.06300/1.0550. Bullish invalidation only if it breaks below 1.0440.

Indicator (4-hour chart)

CCI – bullish

Directional movement index – Bullish

It is good to buy on dips around 1.0718-20 with SL around 1.0660 for a TP of 1.0900.