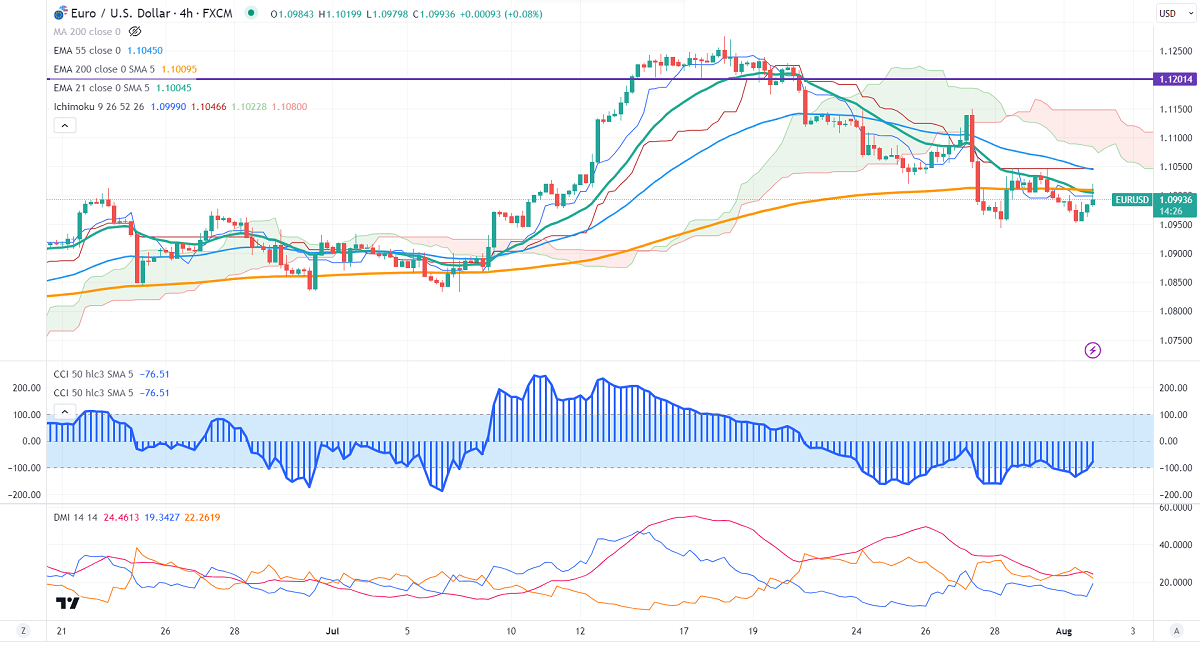

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.09990

Kijun-Sen- 1.10466

EURUSD recovered above 1.1100 on the US credit rating cut. Fitch has downgraded the US credit rating from AAA to AA, quoted "a steady deterioration in standards of governance.". It hits a high of 1.10199 and is currently trading around 1.09947.

According to the Institute of supply management, the US ISM manufacturing index improved to 46 in Jul, below expectations of 46.80.

Major economic data for the day

Aug 2nd, 2023, US ADP employment data (12:15 pm GMT)

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 82.50% from 78.70% a week ago.

The US 10-year yield gained more than 2.5% despite weak US ISM manufacturing PMI. The US 10 and 2-year spread narrowed to -87.10 from -110%.

The pair trades below short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any indicative break below 1.0950 confirms further bearishness: a decline to 1.0900/1.0850 is possible. The near-term resistance is around 1.1050. The breach above targets 1.1150/1.1180.

Indicator (4-hour chart)

CCI – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1000 with SL around 1.1050 for a TP of 10800.