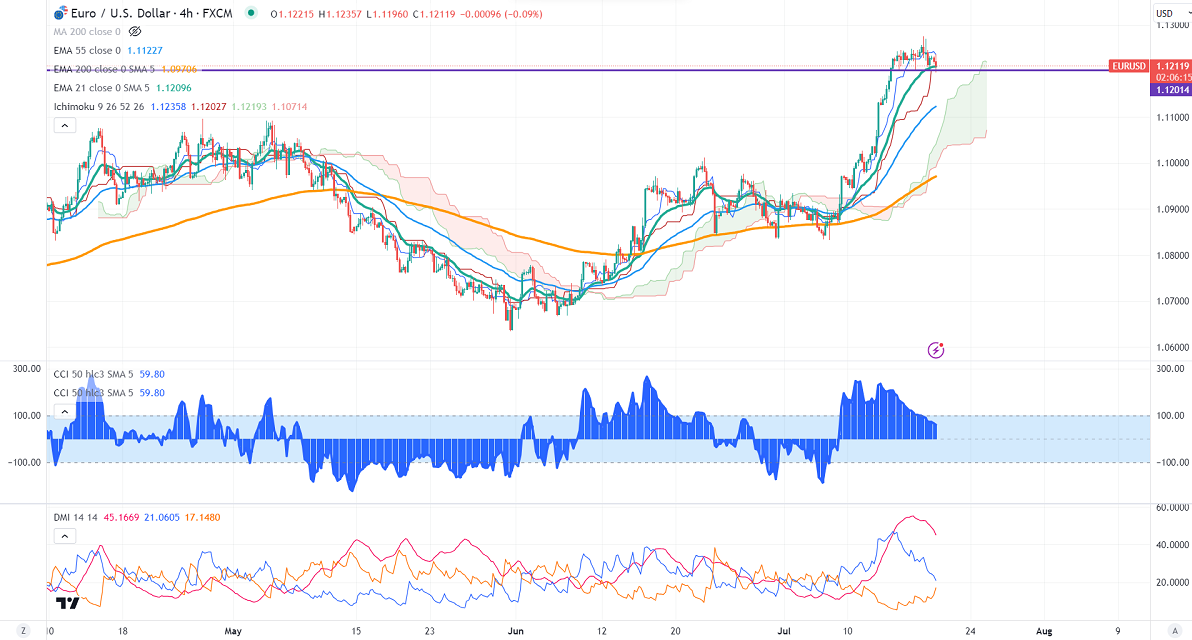

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.12422

Kijun-Sen- 1.12012

EURUSD pared some of its gains despite weak US retail sales. It rose 0.20% last month, below the forecast of 0.40%. Retail sales ex-autos came at 0.20% vs an estimate of 0.30%. European Central Bank governing council member Klaas Knot said that the Central bank could soon halt its aggressive rate hike. It hits an intraday low of 1.12123and is currently trading around 1.2152

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 99.80% from 93% a week ago.

The US 10-year yield is trading weak amid weak US retail sales. The US 10 and 2-year spread narrowed to -97% from -110%.

The pair trades above short-term 21 EMA, 55 EMA, and long-term (200-EMA) in the 4-hour chart. Any indicative break above 1.1275 confirms intraday bullishness; a jump to 1.1300/1.1380 is possible. The near-term support is around 1.1180 The breach below targets 1.1130/1.1070.

Indicator (4-hour chart)

CCI – Bullish

Directional movement index – Bullish

It is good to buy on dip around 1.1180 with SL around 1.1130 for a TP of 1.1300.