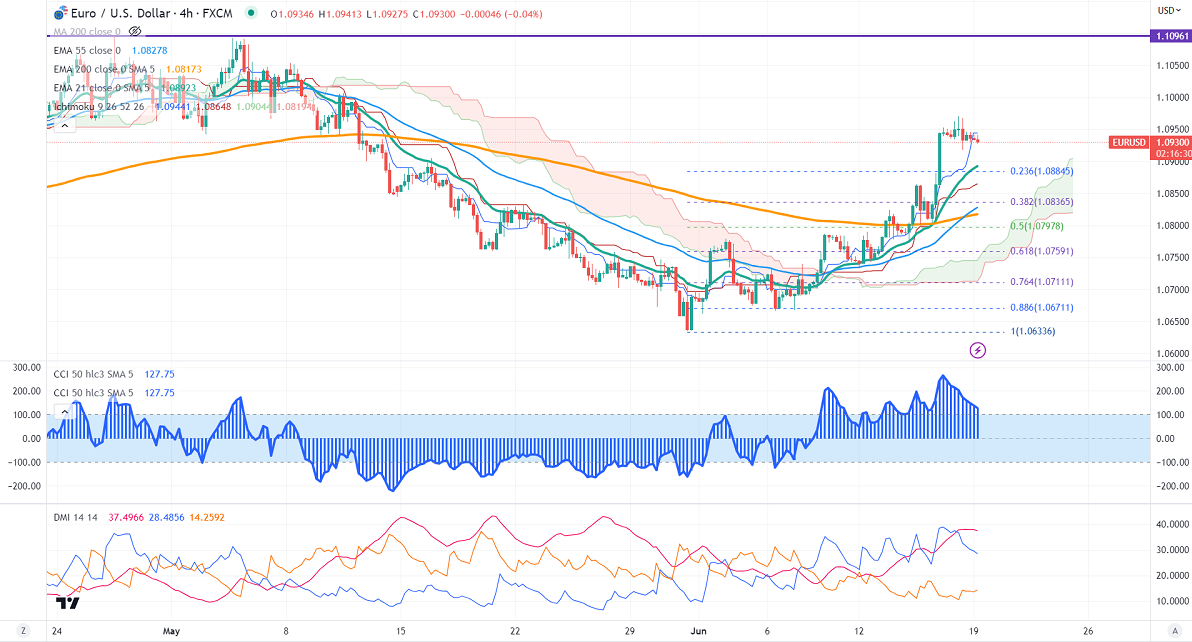

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.09441

Kijun-Sen- 1.08617

EURUSD gained momentum after ECB monetary policy the previous week. The central bank hiked rates by 25 bpbs to 3.50%, the highest since 2001. It has also revised inflation projections for 2023 and 2024. It hits a high of 1.09705 and is currently trading around 1.09311.

US University of Michigan consumer sentiment increased to 63.90 in May compared to a forecast of 60.10.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 71.9% from 52.8% a week ago.

The US 10-year yield pared some of its gains after mixed US economic data. The US 10 and 2-year spread widened to -94% from -35%.

The pair trades above short-term 21 EMA, 55 EMA, and below long-term (200-EMA) in the 4-hour chart. Any indicative break above 1.1000 confirms intraday bullishness; a jump to 1.107/1.1150 is possible. The near-term support is around 1.08800. The breach below targets 1.0828/1.0800.

Indicator (4-hour chart)

CCI – Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.0900 with SL around 1.0860 for a TP of 1.100.