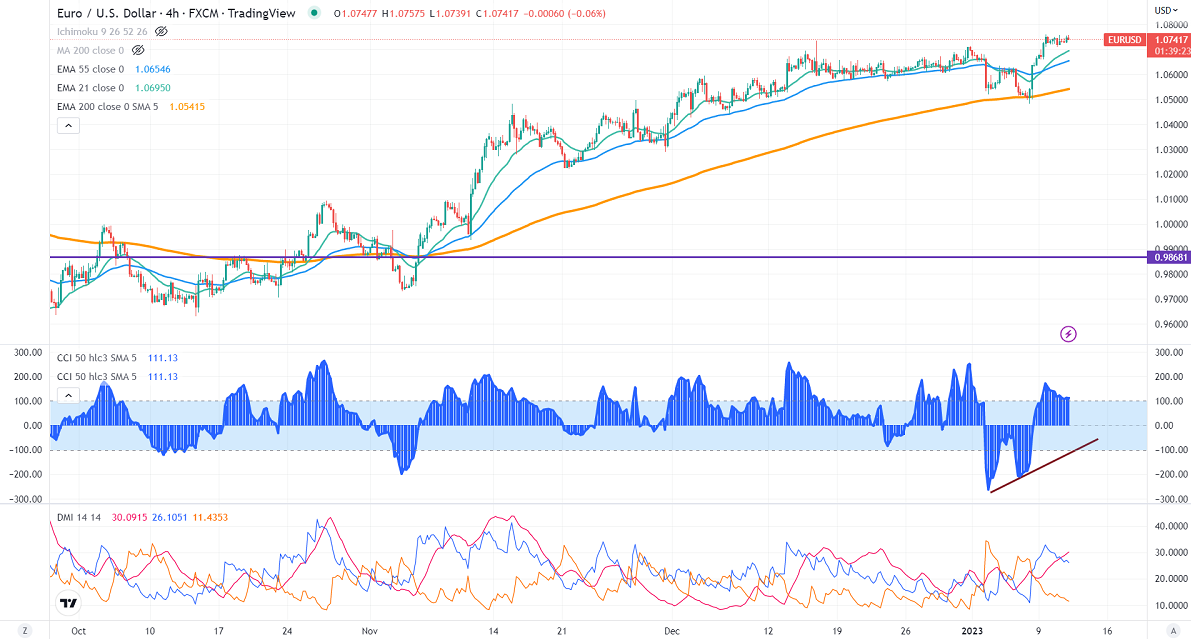

EURUSD trades flat after a massive rally for the past four months. The decrease in policy divergence between Fed and ECB after the dovish rate hike pushed Euro higher. The US treasury yields pared most of their gains made the previous month also dragging the US dollar lower. It hits an intraday high of 1.07575 and is currently trading around 1.07467.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb rose to 79.2% from 69.7% a week ago.

The US 10-year yield showed a minor pullback of 3.5% and trades above 3.60%. Any break and close above 3.69% confirms minor bullishness. The yield spread between 10 and 2-year narrowed to -64.2 basis points from -77 bpbs.

Technical:

On the higher side, near-term resistance is around 1.0760 and any convincing breach above will take the pair to the next level of 1.0800/1.0855.

The pair's immediate support is at 1.0690, breaking below targets of 1.0660/1.0600/1.0570/1.0500.

Indicator (4-hour chart)

Directional movement index – Bullish

CCI(50)- Bullish

It is good to buy on dips around 1.0680-825 with SL around 1.0630 for a TP of 1.0800.