EURUSD trades in a narrow range after a minor pullback to 1.06350. The minutes from Dec 13-14 showed that participants agreed that inflation was high and central bank should continue increasing rates at a slower pace to tackle inflation. No participants are willing to lower interest rates in 2023. The overall trend remains bullish as long as support holds. It hits an intraday high of 1.06278 and is currently trading around 1.06188.

US ISM manufacturing PMI dropped to 48.4 in Dec, the lowest level in 2-1/2 years. Major economic data to watch- US ADP employment and Unemployment claims for further direction.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb rose to 69.1% from 67.8% a week ago.

The US 10-year yield trading weak for the second consecutive day despite hawkish Fed minutes. The yield spread between 10 and 2-year widened to -67.7 basis points from -46.9 bpbs.

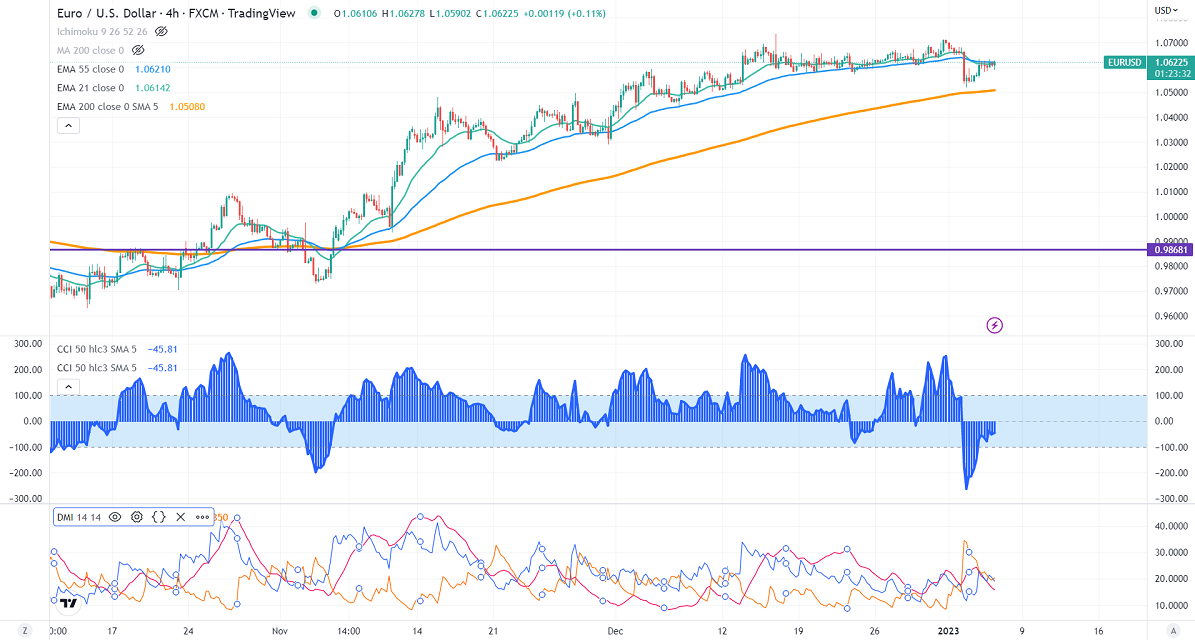

Technical:

On the higher side, near-term resistance is around 1.0660 and any convincing breach above will take the pair to the next level of 1.0725/1.0760/1.0800.

The pair's immediate support is at 1.0570, breaking below targets of 1.0500/1.0435.

Indicator (4-hour chart)

Directional movement index – Neutral

CCI(50)- Bearish

It is good to buy on dips around 1.0570 with SL around 1.0500 for a TP of 1.07250.