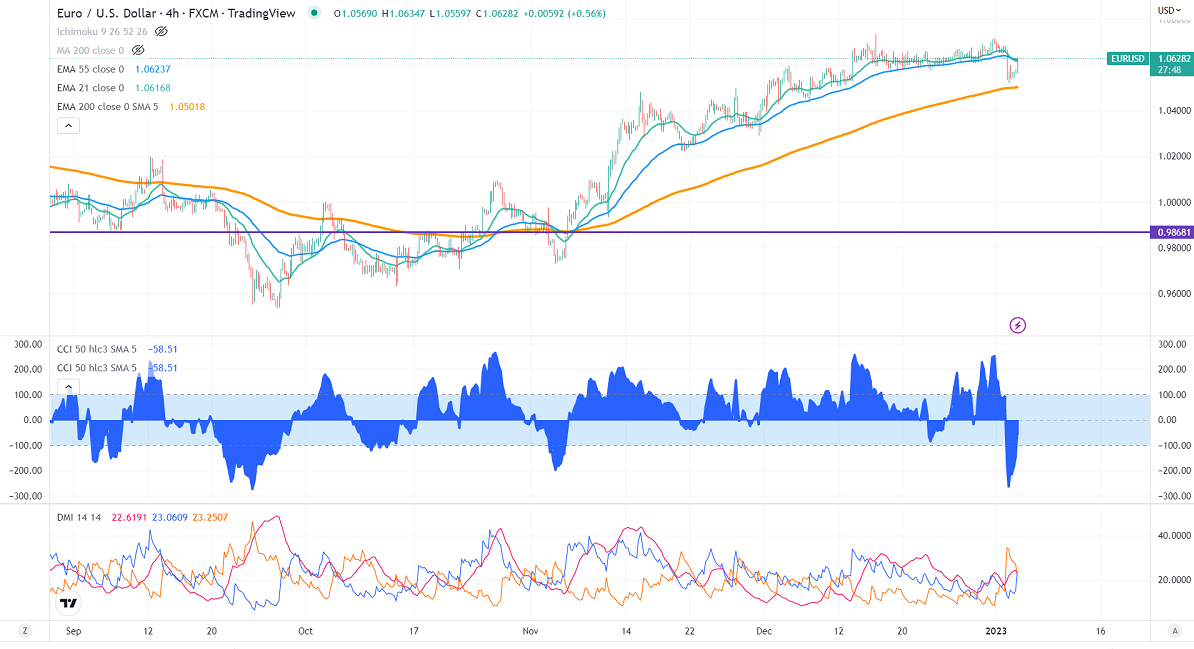

FxWirePro- EURUSD Daily Outlook

EURUSD recovered above 1.0600 ahead of the Fed meeting minutes. The overall trend remains bullish as long as support holds. The hawkish outlook of the European central bank in Dec meeting narrowed policy divergence between US Fed and ECB. It hits an intraday high of 1.06347 and is currently trading around 1.06131.

Euro and German final services PMI came at 49.80 and 49.20, above forecast. Major economic data to watch- US ISM manufacturing index and US Fed meeting minutes for further direction.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb rose to 70.3% from 67.8% a week ago.

The US 10-year yield declined by 6.2% on the global economic outlook. The yield spread between 10 and 2-year widened to -63.8 basis points from -46.9 bpbs.

Technical:

On the higher side, near-term resistance is around 1.0660 and any convincing breach above will take the pair to the next level of 1.0725/1.0760/1.0800.

The pair's immediate support is at 1.0570, breaking below targets of 1.0500/1.0435.

Indicator (4-hour chart)

Directional movement index – Neutral

CCI(50)- Bullish

It is good to buy on dips around 1.0600 with SL around 1.0540 for a TP of 1.07250.