EURUSD surges past 1.06500 in the European session on board-based US dollar selling. The rebound in the US stock market pushed Euro higher. The renewed spread of Covid new variants across the globe will cap further upside in the pair. Markets eye US final GDP and initial jobless claims for further direction. It hits an intraday high of 1.06593 and is currently trading around 1.06334.

US CB consumer confidence improved to 108.30 in Dec, above the estimate of 101.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec rose to 70% from 57.3% a week ago.

The US 10-year yield traded higher for the third consecutive day. The US 10 and 2-year spread narrowed to -55 basis points from -85 bpbs.

Technical:

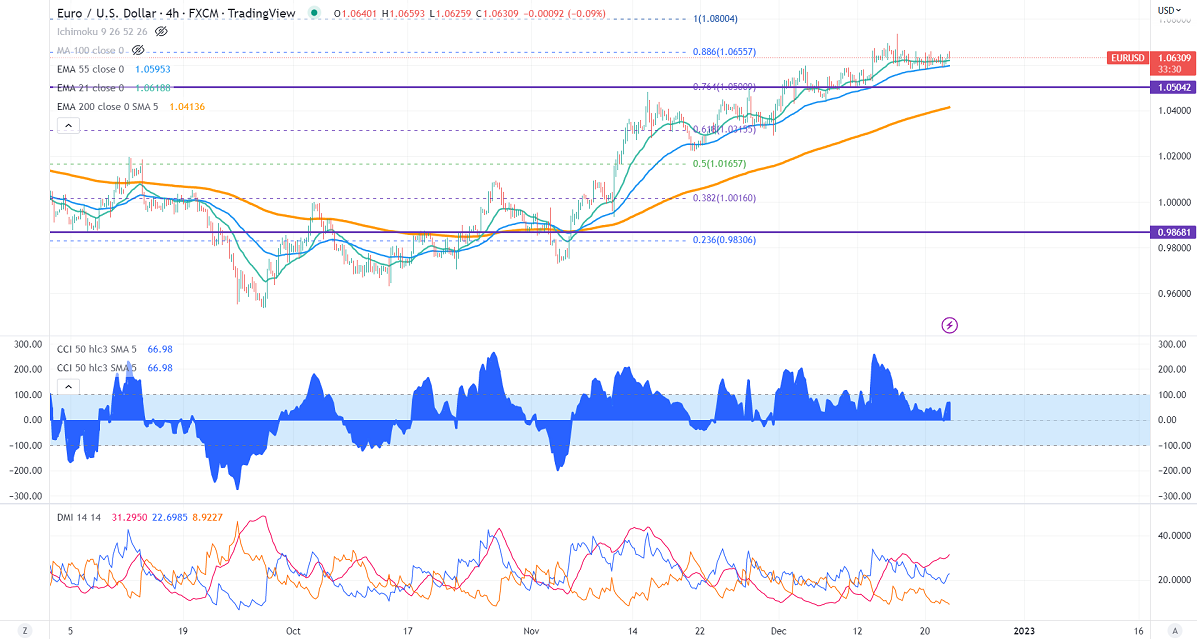

On the higher side, near-term resistance is around 1.0660 and any convincing breach above will drag the pair to the next level of 1.0725/1.0800

The pair's immediate support is at 1.0570, breaking below targets of 1.0500/1.0435.

Indicator (4-hour chart)

Directional movement index – Bullish

It is good to buy on dips around 1.0570 with SL around 1.0500 for a TP of 1.0720.