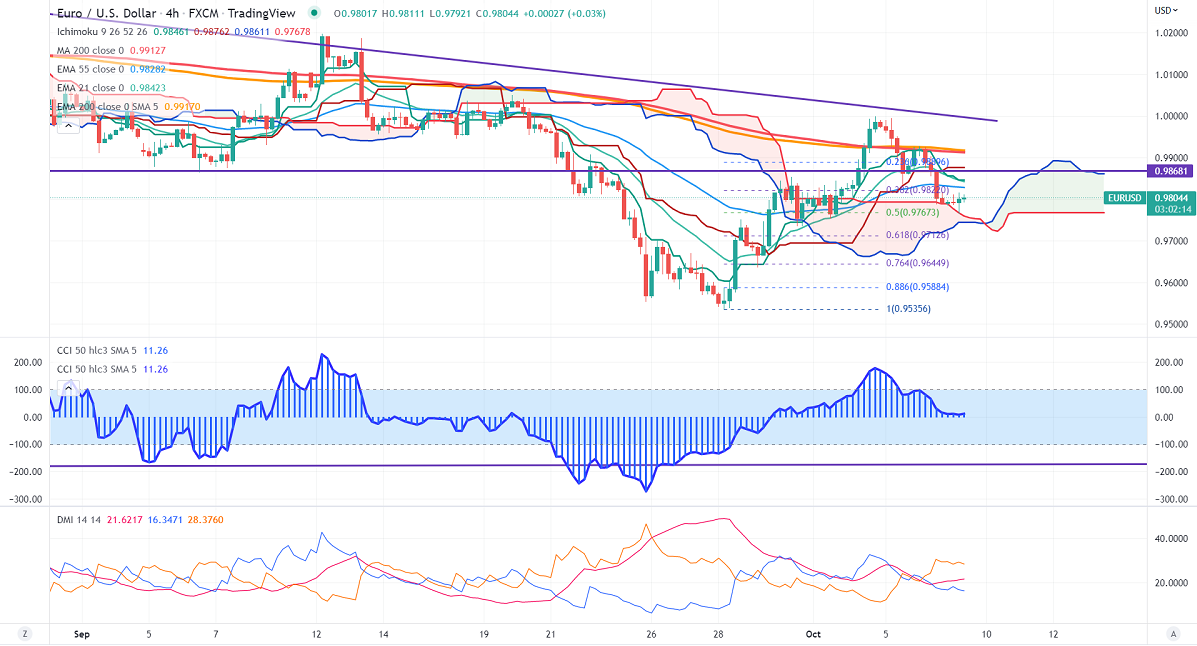

Ichimoku analysis (4-hour chart)

Tenken-Sen- 0.98461

Kijun-Sen- 0.98762

EURUSD recovered more than 50 pips in the European session ahead of US Non-Farm payroll data.US economy is expected to add 248K in Sep compared to the previous month's 315K. Any dismal jobs data will push the Euro higher to the 1.0000 level. German retail sales and industrial production came below estimates.

US treasury yields pared some of their loss after hawkish commentary by Minneapolis Fed President Kashkari.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov rose to 75.9% from 53.20% a week ago.

EURUSD hits a low of 0.97656 and is currently trading around 0.98093.

Technical:

On the higher side, near-term resistance is around 0.9860 and any convincing breach above will drag the pair to the next level of 0.9920/0.9965/1.00500/1.0200.

The pair's immediate support is at 0.9760, breaking below targets of 0.9700/0.9630/0.9600.

Indicator (4-hour chart)

Directional movement index – Bearish

It is good to sell on rallies around 0.9828-30 with SL around 0.9900 for a TP of 0.95360.