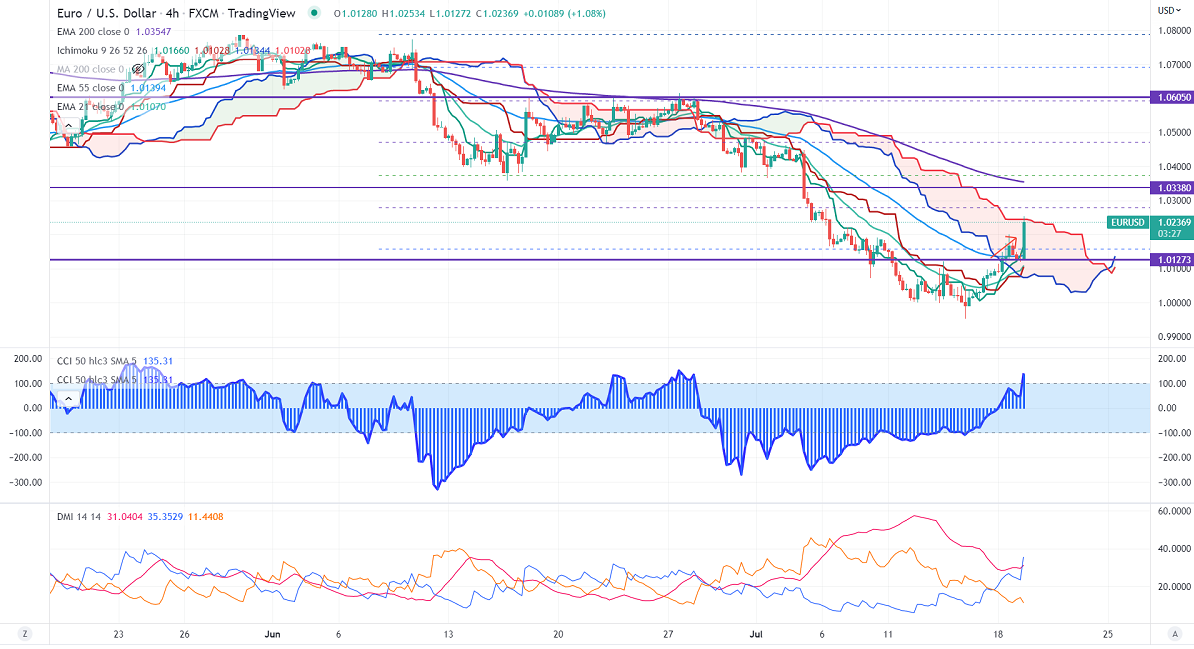

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.01368

Kijun-Sen- 1.00767

EURUSD gained more than 100 bpbs on board-based US dollar selling. Euro gained momentum against all majors after a Reuters report said that European Central Bank expected to hike rates by 25 or 50 bpbs at their meeting on Thursday. According to the CME Fed watch tool, the probability of a 100 bpbs rate hike in Jul rose to 30.9% from 29.1% a day ago.

EURUSD hits an intraday high of 1.02534 and is currently trading around 1.02298.

Technical:

On the higher side, near-term resistance is around 1.0300 and any convincing breach above will drag the pair to the next level of 1.0350/1.0500/1.075.

The pair's immediate support is at 1.010, breaking below targets of 1/0.9940.

Indicator (hourly chart)

Directional movement index – Bullish

It is good to buy on dips around 1.0200 with SL around 1 for a TP of 1.075.