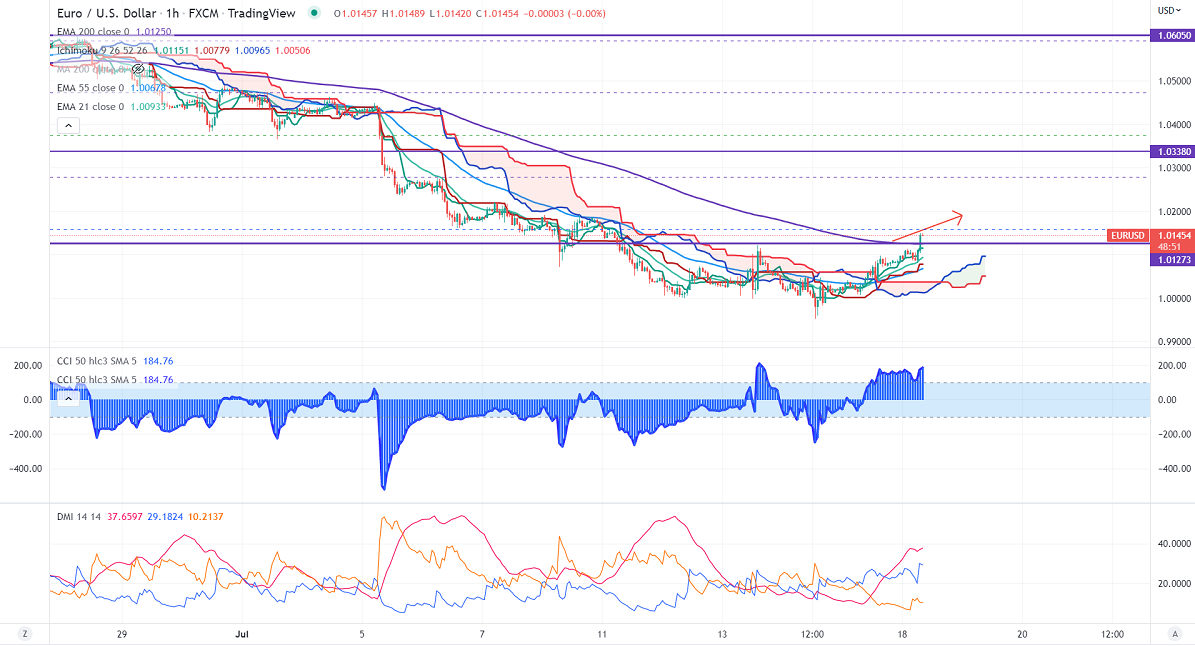

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.01146

Kijun-Sen- 1.00779

EURUSD continues its bullish momentum and jumped more than 60 pips in today's Asian session. The board-based US dollar selling as the chance of an aggressive rate hike by the Fed diminishes. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jul dropped to 71.5% from 92.4% a day ago. Markets eye the European Central Bank monetary policy to be released on Thursday for further direction.US retail sales rose by 1% m/min in June compared to a forecast of 0.70%. EURUSD hits an intraday high of 1.0490 and is currently trading around 1.01410.

Technical:

On the higher side, near-term resistance is around 1.0150 and any convincing breach above will drag the pair to the next level of 1.02785/1.0390.

The pair's immediate support is at 1.0080, breaking below targets of 1/0.9940.

Indicator (hourly chart)

Directional movement index – Bullish

It is good to buy above 1.014 with SL around 1.010 for a TP of 1.0280/1.0390.