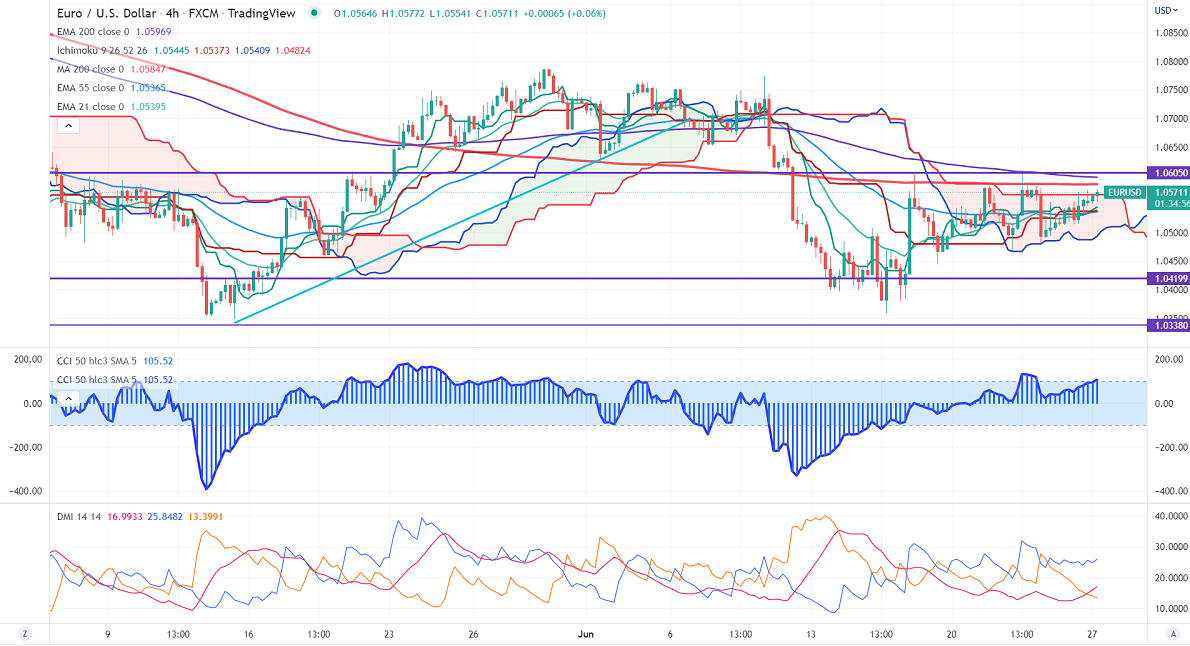

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.05396

Kijun-Sen- 1.0373

EURUSD regained above 1.0550 on improved market sentiment. The dismal Eurozone PMI and German IFO data have increased the chance of a recession in Europe preventing the pair from further upside. Markets eye US durable goods orders and pending home sales for further direction. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jul declined to 85.6% from 83.8% a week ago. EURUSD hits an intraday high of 1.05772 and is currently trading around 1.05685.

Technical:

On the higher side, near-term resistance is around 1.0600 and any convincing breach above will drag the pair to the next level of 1.0660/1.0725.

The pair's immediate support is at 1.0460, breaking below targets of 1.0400/1.0340.

Indicator (4-hour chart)

Directional movement index – Bearish

It is good to buy above 1.0600 with SL around 1.0550 for a TP of 1.0700.