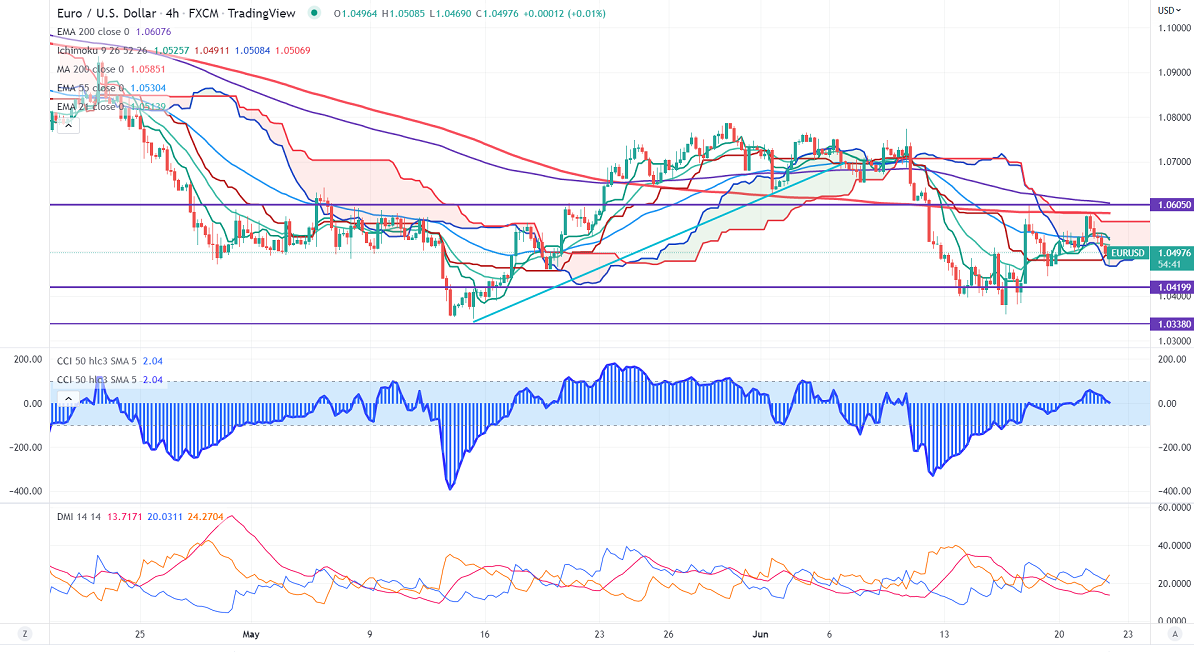

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.05379

Kijun-Sen- 1.04911

EURUSD pared some of its gains made yesterday on risk aversion. Economic recession fears along with hawkish Fed rate hike supporting safe-haven currencies such as the US dollar. Markets eye US Fed chairman testimony and EU summit for further direction. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jul increased to 96.9% from 88..5% a week ago. EURUSD hits an intraday low of 1.03580 and is currently trading around 1.03973.

Technical:

On the higher side, near-term resistance is around 1.0600 and any convincing breach above will drag the pair to the next level of 1.0660/1.0725.

The pair's immediate support is at 1.0460, breaking below targets of 1.0400/1.0340.

Indicator (4-hour chart)

Directional movement index – Bearish

It is good to sell on rallies around 1.05280-30 with SL around 1.0600 for a TP of 1.0340.