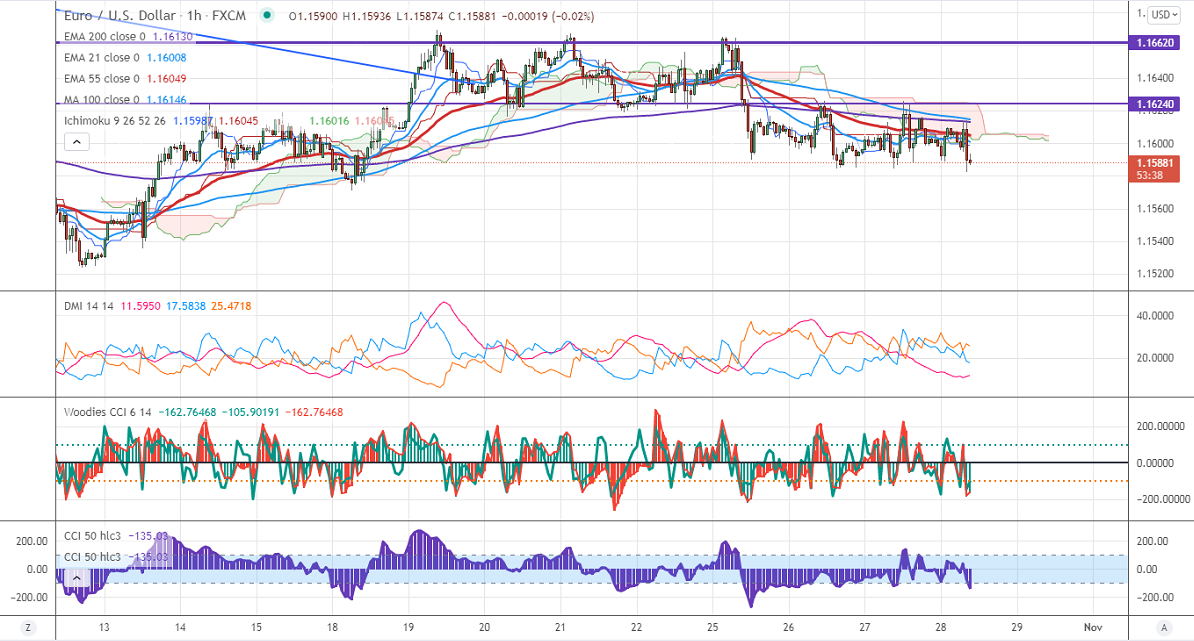

Ichimoku analysis (1-hour chart)

Tenken-Sen- 1.15987

Kijun-Sen- 1.16045

EURUSD is trading in a narrow range between 1.16256 and 1.15845 for the past three days. Investor's eyes ECB monetary policy today for further direction. The central bank is expected to keep rates unchanged. Any reduction in the Pandemic purchase program (PEPP) will have a positive impact on the Euro currency. It hits an intraday low of 1.15831 and is currently trading around 1.15932.

Technical:

On the higher side, near-term resistance is around 1.1630 and any convincing breach above will drag the pair to the next level 1.16650/1.17010/1.1760. The pair's immediate support is at 1.1580, breaking below targets of 1.1525.

Indicator (1-hour chart)

Directional movement index – Neutral

It is good to sell on rallies around 1.1660-625 with SL around 1.17010 for a TP of 1.1525.