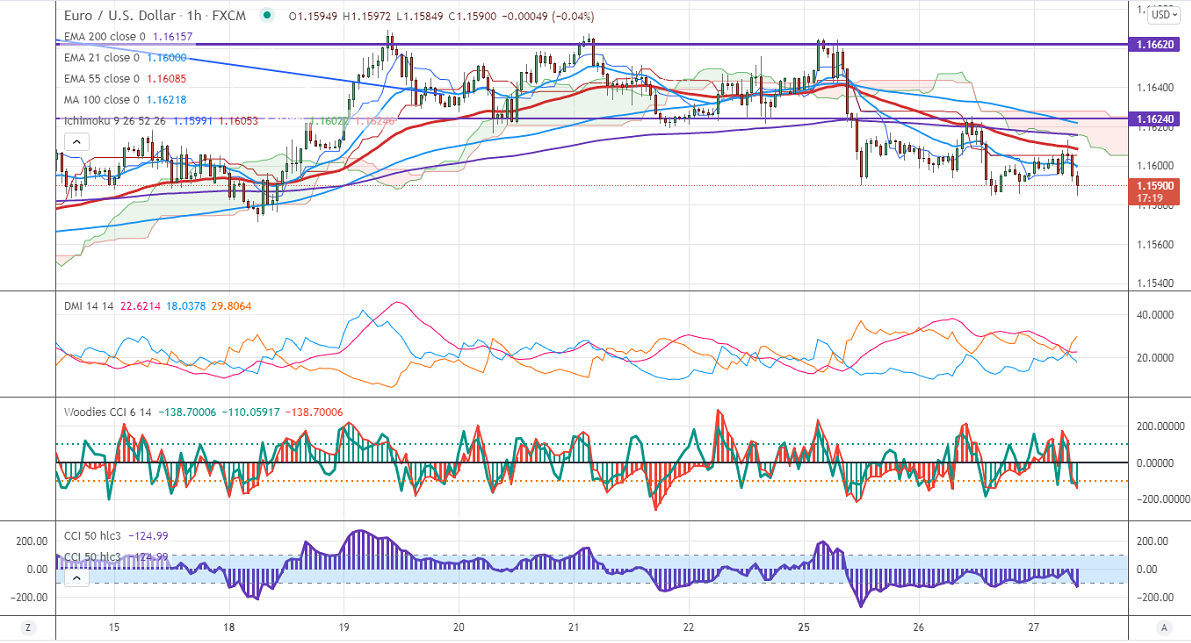

Ichimoku analysis (1-hour chart)

Tenken-Sen- 1.16026

Kijun-Sen- 1.16053

EURUSD is trading flat after a minor sell-off till 1.15849. Investors eagerly await European Central bank monetary policy tomorrow for further direction. The central bank is expected to keep rates unchanged and to maintain a dovish stance on weak Euro economic data. It hits an intraday low of 1.15907 and is currently trading around 1.15932.

Technical:

On the higher side, near-term resistance is around 1.1630 and any convincing breach above will drag the pair to the next level 1.16650/1.17010/1.1760. The pair's immediate support is at 1.1580, breaking below targets of 1.1525.

Indicator (1-hour chart)

Directional movement index – Neutral

It is good to sell on rallies around 1.1660-625 with SL around 1.17010 for a TP of 1.1525.

FxWirePro- EURUSD Daily Outlook

Wednesday, October 27, 2021 4:24 PM UTC

Editor's Picks

- Market Data

Most Popular