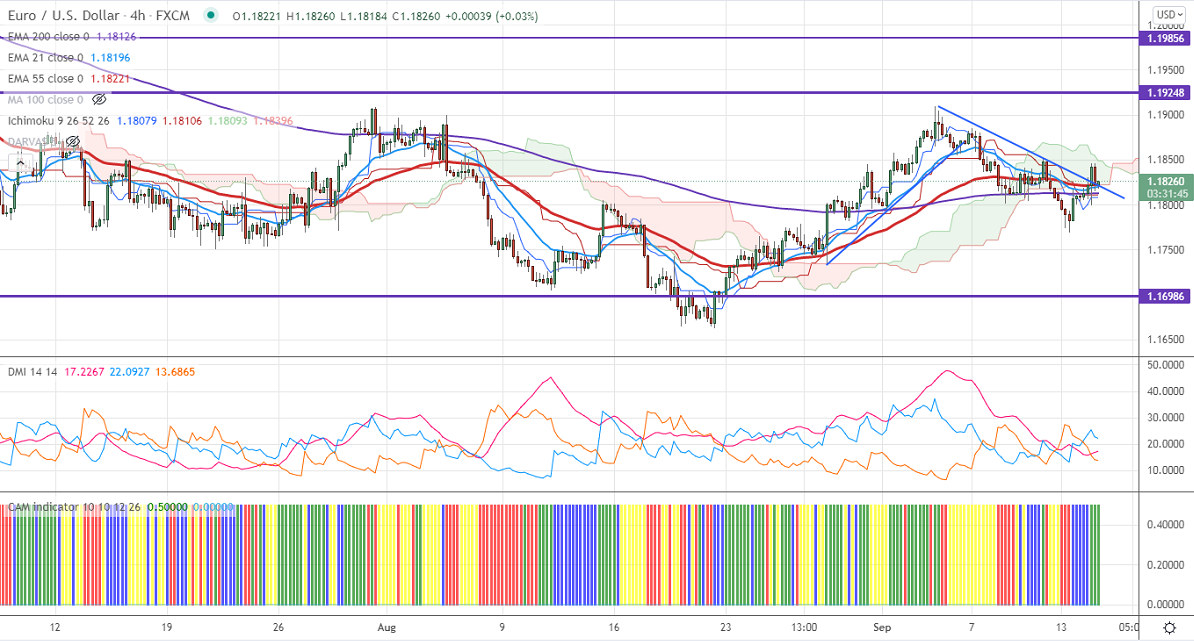

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.18079

Kijun-Sen- 1.18106

EURUSD has shown a minor pullback of more than 40 pips posts US CPI data. It rose by 0.3% in August compared to a forecast of 0.4%. The headline inflation for the year jumped to 5.3%, in with expectations. The pair hits an intraday high of 1.18457 and is currently trading around 1.18253.

Technical:

On the higher side, near-term resistance is around 1.1865 and any convincing breach above will drag the pair to the next level 1.19070/1.1920/1.1965. The pair's immediate support is at 1.1760, break above targets 1.1700/1.1660.

Indicator (4-hour chart)

CAM indicator-Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.1818-200 with SL around 1.1770 for the TP of 1.19080.