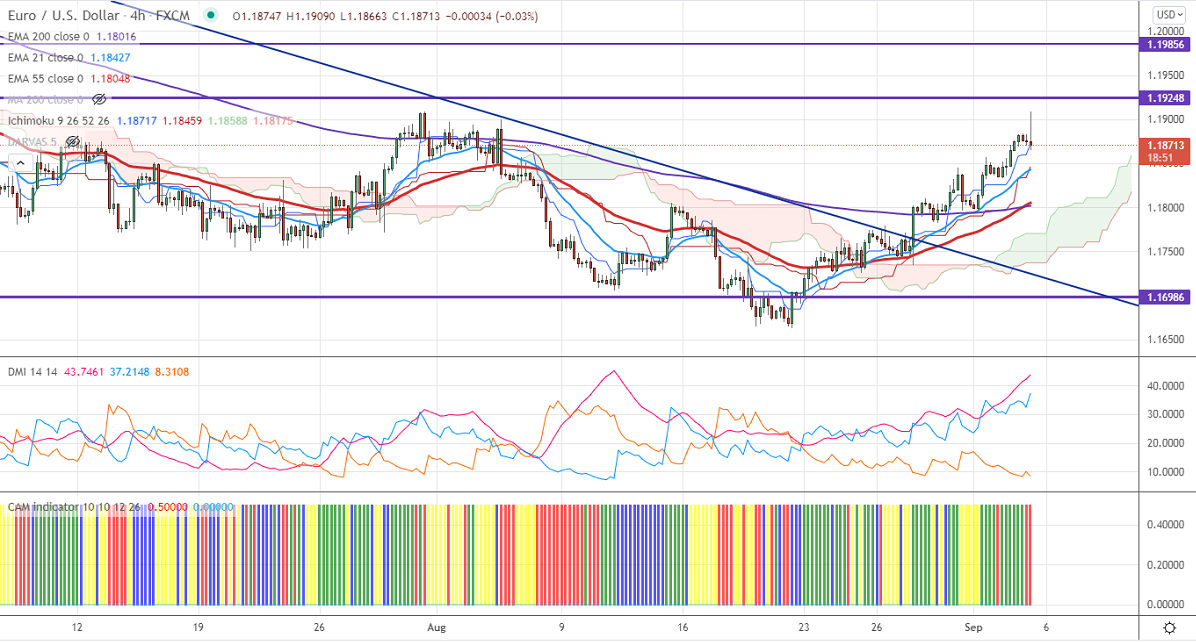

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.18594

Kijun-Sen- 1.18335

EURUSD more than 30 pips after US Nonfarm payroll data. The US economy has added 235000 jobs in August compared to an estimate of 720000. The Unemployment came at 5.2% in line with the estimate. Average hourly earnings surged by 0.6% MoM and 4.3% YoY. The US 10-year yield recovered more than 3% from a low of 1.267%. EURUSD hits an intraday high of 1.19090 and is currently trading around 1.18837.

Technical:

On the higher side, near-term resistance is around 1.1920 and any convincing breach above will take to the next level 1.1965/1.2000. The pair's near-term support is at 1.1850, break below targets 1.1800/1.1780/1.1750.

Indicator (4-hour chart)

CAM indicator-Bullish

Directional movement index – Bullish

It is good to buy on dips around 1.1878-800 with SL around 1.1830 for the TP of 1.2000.