Ichimoku analysis (60 min chart)

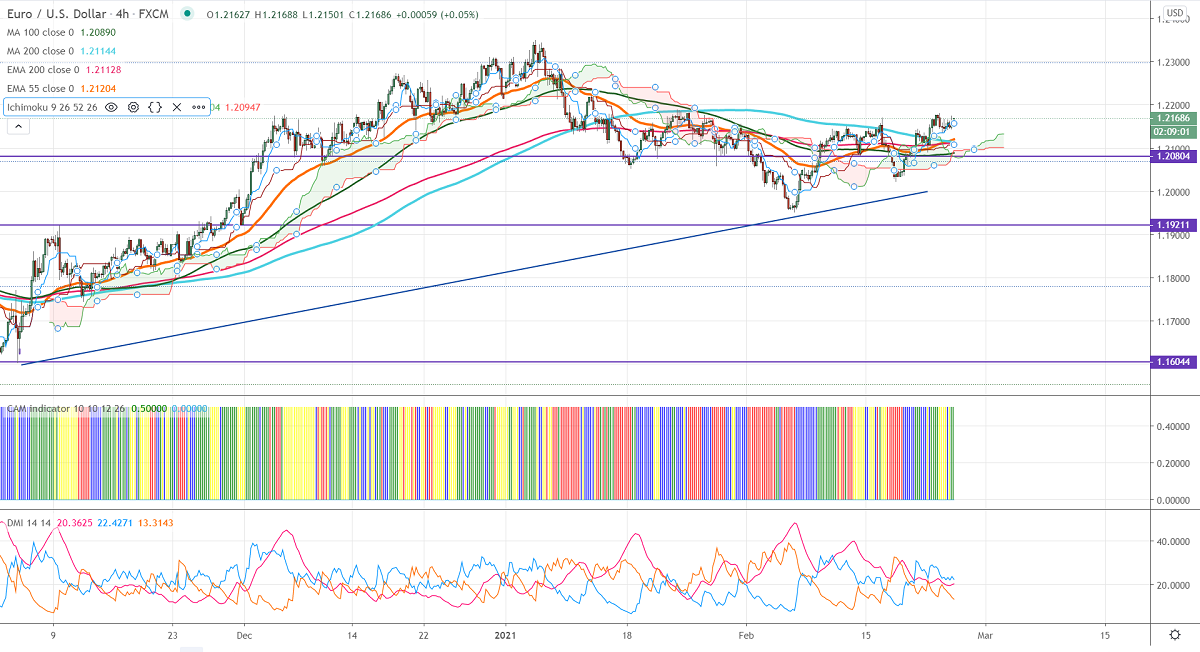

Tenken-Sen- 1.21577

Kijun-Sen- 1.21079

EURUSD recovered slightly after dovish comments from Fed Chairman Powell. He stated that the central bank will continue to provide keep Quantitative easing until maximum employment and inflation target 2% met. -month high on more stimulus hopes which will increase inflation. DXY is trading weak, any violation below 89.90 confirms further weakness. The index of consumer confidence rose to a 3-month high at 91.3 in Feb better than the forecast of 90.

EURUSD hits an Intraday high of 1.21747 and is currently trading around 1.21630.

Technical:

The pair is facing strong support at 1.21150. Any break below confirms minor bearishness, a jump till 1.2090/1.2060/1.2020 likely. The near-term resistance is around 1.2180. Breach below will drag the pair up till 1.2200/1.2260.

Indicator (60 min chart)

CAM indicator – bullish

Directional movement index – bullish

It is good to sell on rallies around 1.2105-60 with SL around 1.2170 for the TP of 1.2000.