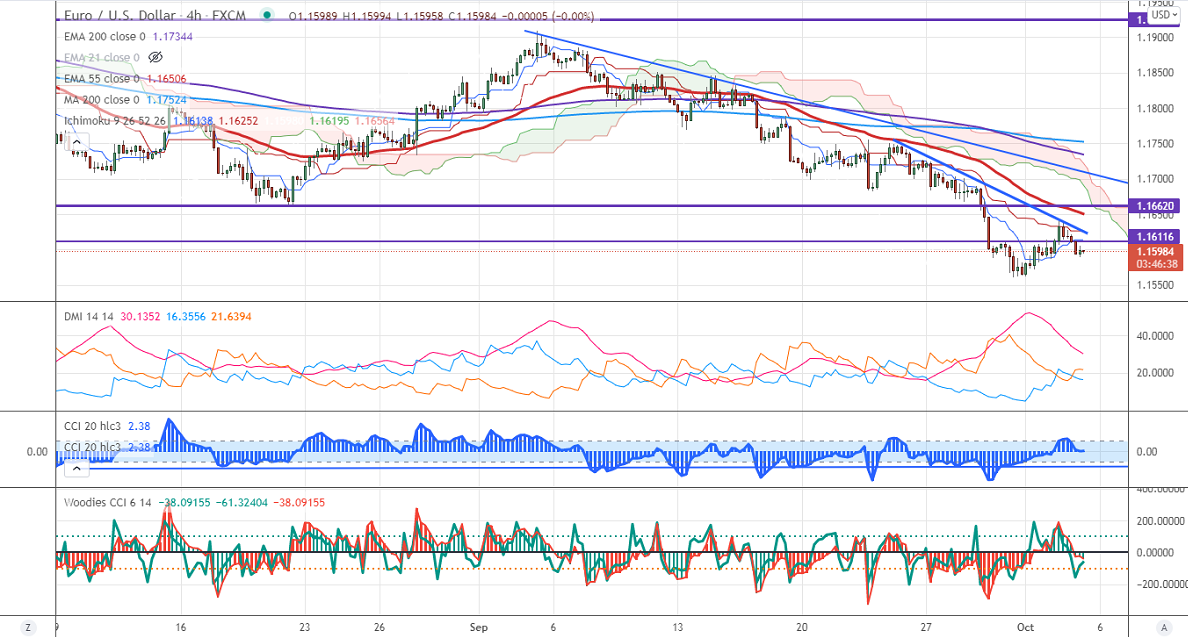

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.16138

Kijun-Sen- 1.1626

EURUSD has pared most of its gains made yesterday and hovering near 1.16000 level. The US debt ceiling and Chinese Evergrande's crisis is supporting the US dollar at lower levels. The Markit German and Eurozone services PMI came slightly better than forecast. The minor sell-off in US treasury yield after hitting a multi-week high is protecting EURUSD from further fall. It hits an intraday high of 1.16046 and is currently trading around 1.16011.

Technical:

On the higher side, near-term resistance is around 1.1650 and any convincing breach above will drag the pair to the next level 1.17010/1.1760. The pair's immediate support is at 1.1560, break below targets 1.1500.

Indicator (4-hour chart)

Directional movement index – Neutral

It is good to buy on dips around 1.15900 with SL around 1.1550 for TP of 1.1700.