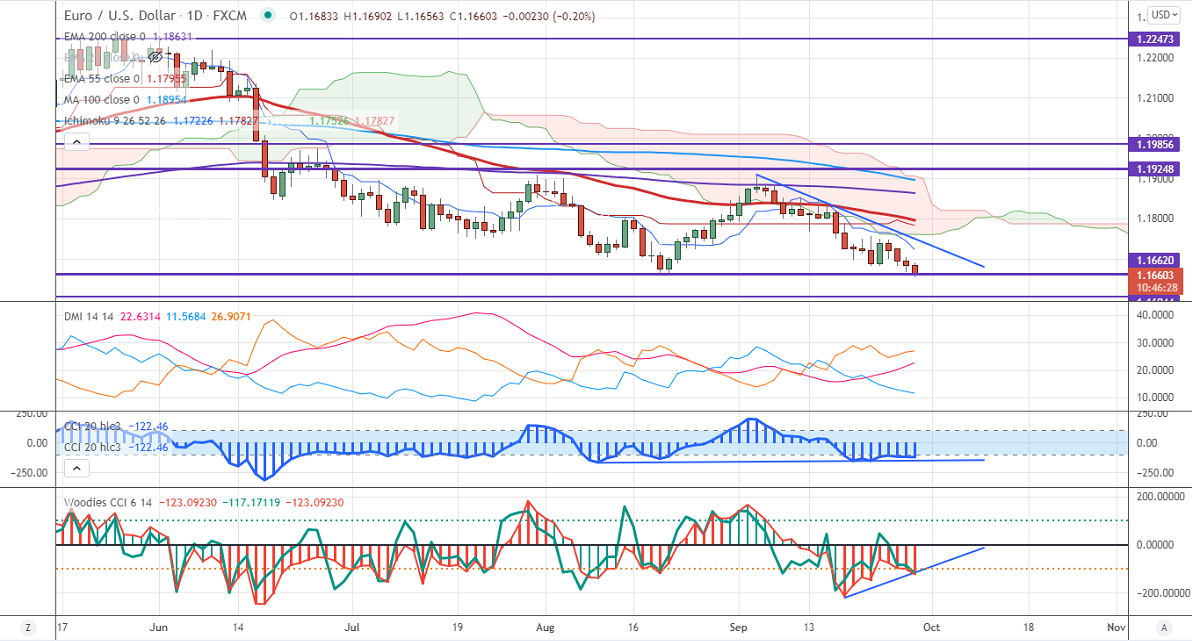

Ichimoku analysis (Daily chart)

Tenken-Sen- 1.17444

Kijun-Sen- 1.17886

EURUSD continues to trade lower and hits fresh yearly lows on board-based US dollar buying. The decrease in risk appetite is due to Chinese Evergrande's default risk and US debt ceiling concern. The surge in US treasury yield also supporting the greenback. Markets eye US Fed chairman Powell speech and CB Consumer confidence for further direction. It hits an intraday low of 1.16563 and is currently trading around 1.16611

Technical:

On the higher side, near-term resistance is around 1.17010 and any convincing breach above will drag the pair to the next level 1.1765/1.1800/1.1850/1.18850/1.1920. The pair's immediate support is at 1.1650, break below targets 1.1600/1.1564.

Indicator (Daily chart)

Directional movement index – Bearish

It is good to buy on dips around 1.16500 with SL around 1.1600 for the TP of 1.1755.