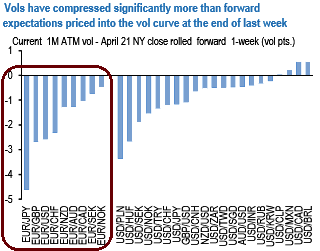

Well anticipated French election outcome on April 24th saw vols fall meaningfully below 1-day forward levels from last week’s close. Even adjusting for the sharp decline baked into forward vols to account for the passage of event risk, FX vols are materially lower than ex-ante forward roll expectations (chart 1).

The risk premium squeeze owes not only to a no-drama first round outcome, but also reduction of forward-looking expectations of a surprise from the 2nd round vote on May 7th with the market now more sanguine about the accuracy of opinion polls showing Macron with a 20-point lead over Le Pen.

Overnight vol for the second round vote in EURUSD, for instance, has fallen from 40 to 24 over the past week; EURJPY (-28 pts.), EURGBP (-17 pts.) and USDJPY (-11 pts.) have all suffered meaningful day-weight declines.

There is some, albeit limited room to chase front-end EUR options lower after this compression. 1M ATMs may have 0.5-1.0 vol to subside to converge to realized vols, which themselves are likely to fall as the initial euphoria gives way to a period of deliberation and consolidation during which the market absorbs the ECB’s dogged cautiousness on inflation.

The flatness of the 2M-1M vol curve is at odds with the mildly upward sloping vol curve elsewhere say in USDJPY and USDCHF, and is unsustainable in an environment of narrowing risk premia, hence we tactically sold 1M 25D EUR put strikes in long/short RV against JPY gamma.

Please be noted that the above nutshell evidencing delta risk reversal numbers are flashing up higher negative prints to indicate the mounting hedging interests for bearish risks. 25-delta risk reversals would imply that the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. Negative value also implies puts are more expensive than calls (downside protection is relatively more expensive).

However, EUR-cross-risk-reversals have understandably re-priced sharply in the direction of EUR calls, especially against G10 commodity currencies that were among the worst performers on the week. We struggle to see severe dislocations in this space at current levels, with some mild value only in EURCAD 3M riskies at 0.4 which we are not inclined to chase in light of the cheapness of the loonie on short-term models and the potential for an oil rebound in coming weeks that can cap the extent of EURCAD strength. EURCNH riskies (3M 25D -0.05) however strike us as interesting buys.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate