Last week, we saw Euro area composite PMI posting a solid gain in October, signaling 1.8% ar GDP growth.

The improvement was broad-based by sector and country and was reinforced by IFO and EC surveys.

Last week’s Q3’16 flash GDP prints an unchanged 0.3% QoQ, SAAR growth, with modest downside risks, while Japan managed to produce an upbeat numbers of 0.5% versus forecasts of 0.2% and previous 0.2%.

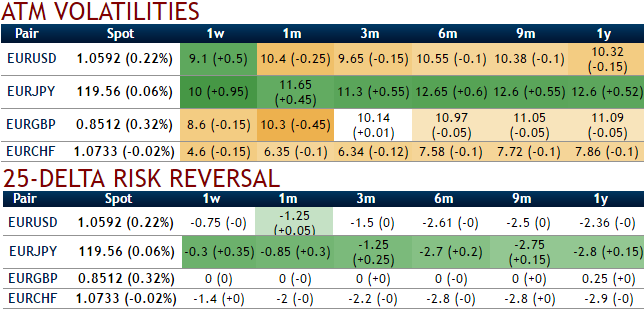

Ahead of today’s Draghi’s speech, 1w IVs of this pair are rising but you could make out from the skewness of the IVs that are active to signify their interest on either of the spot FX moves. While long-term foreign traders firmly destined to hedge the further downside risks. Let’s also observe 1w risk reversals with positive flashes, compare these computations with ongoing rallies of EURJPY, hence, we reckon capitalizing the rallies optimally utilize in option strategy for downside risks.

The ECB used yesterday’s presentation of its semi-annual financial stability report to take the position regarding the referendum in Italy taking place on 4th December. If Matteo Renzi’s proposal of constitutional reform fails, as the polls suggest, there may be early elections – and higher risk premiums for Italian government bonds.

Not only is the ECB concerned that this may cause unrest on the financial markets. The FX market is nervous too. The implied EURUSD volatility for the coming two weeks recently rose to the levels seen during the rather volatile US election night (see above chart).

As a result, ECB Vice-President Vítor Constâncio underlined yesterday that the ECB would react to “shocks” caused by the Italian referendum. That means Italian politics may become decisive for the ECB meeting on 8th December. We expect the ECB to announce an extension of its bonds purchasing program beyond March 2017 at its last meeting of the year.

The implied volatility of ATM contracts for near month expiries of this the pair are reducing below 10.5% which is good for option writers.

While delta risk reversals flashing up progressively with positive numbers (especially in the case of EURUSD and EURJPY) that signify hedging arrangements for upside risks over the period of time.

Hence, considering OTC market reasoning we think upside risks is on the cards, as result we reckon deploying ATM instruments in hedging strategies are worthwhile.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays