- EUR/USD broken the high of 1.14450 made on Jun 29th 2017 and jumped till 1.14893. The pair surges higher on expectations of ECB stimulus exit. It is currently trading around 1.14682.

- Market awaits Fed Chairman Jannet Yellen testimony to Congress today for further direction. ECB expect to taper in Sep or Oct on account of improving economic and inflation outlook.

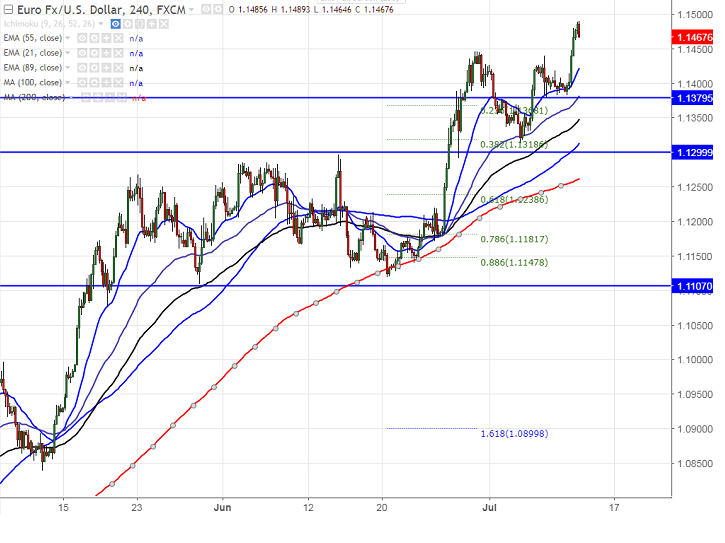

- Technically minor intraday weakness can be seen only below 1.1380 level. Any break below that level will drag the pair down till 1.1344 (89- 4H EMA)/1.1300. Major reversal can be seen only below 1.1290.the minor support is around 1.1440 (resistance turned into support)/1.1400.

- On the higher side, 1.1500 will be acting as major resistance any violation above targets 1.1566.

It is good to buy on dips around 1.1435 with SL around 1.1380 for the TP of 1.1560.