Rationale:

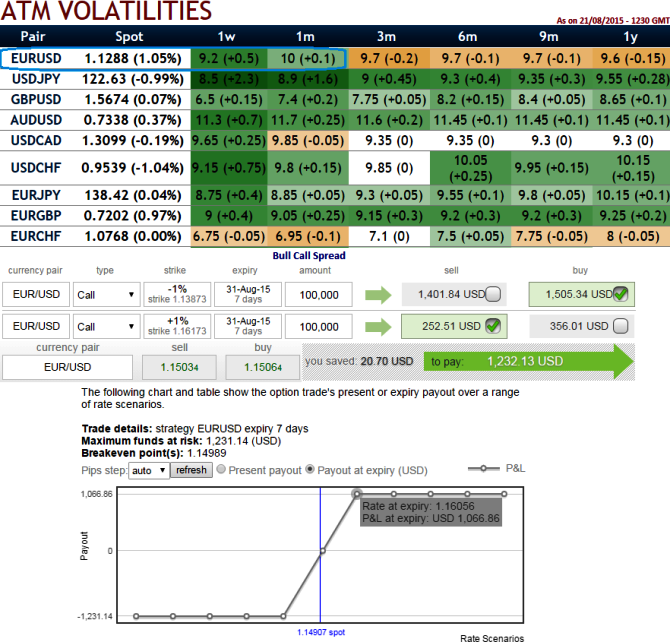

ATM Vols: We can observe ATM vols for EUR pairing against dollar than any other currency cross is a bit higher side for next 1 to 3 months period probably due to Chinese currency devaluation and Fed's speculation. We cannot afford to miss this speculating opportunities as this pair sensing second highest HY vols among the pool.

Technical Watch:

For Euro, 2014 has been a nightmare as technicals did not evidence a single bull candle on monthly charts in entire year. It was a nonstop loosing steak but this year the pair little strength with healthy volume confirmation.

Stochastic: Prevailing uptrend to persist as %K crossover near 20 levels signifies rising prices are intensified by buying interest.

20 day Moving averages: This lagging indicator is suggesting prices for current trend is moving in quite right direction short term remains deceptive.

RSI: Upswings are supported by this oscillating strength index on weekly charts as we saw positive convergence with rise in price.

FX Option Strategies:

Since short term uptrend is anticipated we like to extract the leverage benefits from Call spreads instead of naked calls, buying 15D (-1%) In-The-Money 0.5 delta call, while shorting 7D (1%) Out-Of-The-Money call for a net dedit as shown in the diagram.

As the bull put spread is a long position and a net credit strategy, Vega is negative when the position is profitable and positive when the position is unprofitable. It means that an increase in implied volatility is harmful to your position when it is OTM and helpful when your position is ITM. Vega is greatest for options far from expiration and becomes less important while options approach expiration. As a result, the effect of implied volatility on the bull put spread, which is a strategy to trade on a short-term basis, becomes minimal.

FxWirePro: EUR/USD gains on Chinese devaluation, vega spreads reduces upside risks in short run

Monday, August 24, 2015 12:02 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings