- EURUSD has broken 18 month high of 1.18455 made yesterday and jumped till 1.18680 at the time of writing. The pair declined till 1.17850 yesterday on account of profit booking. It is currently trading around 1.18336 0.27% higher.

- Market awaits U.S ADP employment data which is to be released today 1.15 PM (GMT) for further direction. U.S dollar weakness was mainly due to political uncertainty in Washington after Trump ouster of White house communications Chief Anthony Scaramucci on Monday.

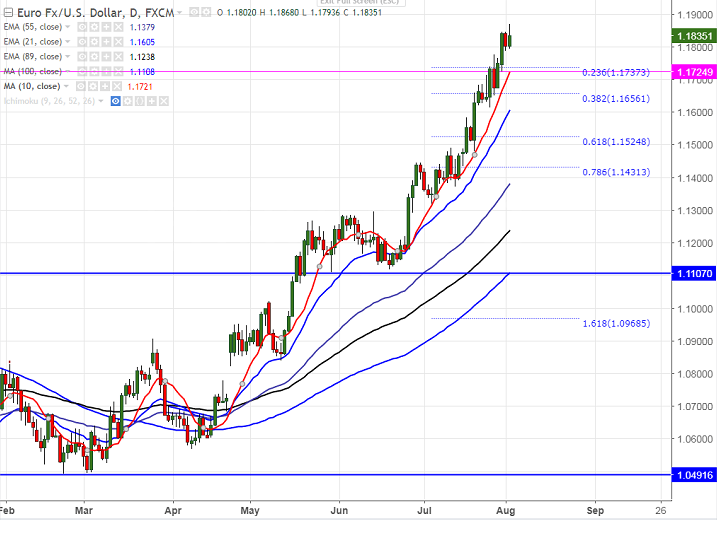

- The pair has closed above major resistance at 1.17768 high made on Jul 27th 2017. Any convincing break above 1.18500 will take the pair till 1.1880/1.1900/1.1975 (2015 yearly high).

- On the lower side, 1.17600 (5- day MA) will be acting as near term support and any break below will drag the pair down till 1.17350 (23.6% Retracement of 1.13123 and 1.18680)/1.1685 (10- day MA).Minor weakness can be seen only below 1.1600.

It is good to buy on dips around 1.1800 with SL around 1.17500 for the TP of 1.200/1.2510.