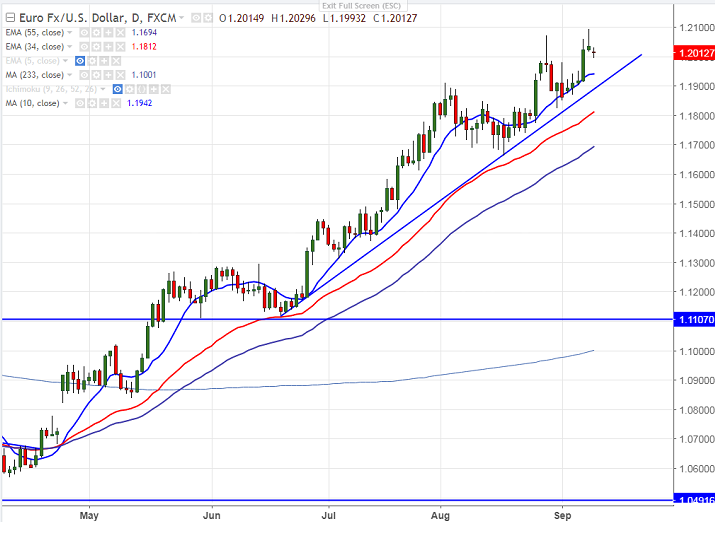

- EUR/USD has shown a major sell off after hitting 33- month high of 1.20922 on Aug 8th 2017. The pair declined till 1.19932 and is currently trading around 1.20117.

- The pair has taken support near 20 -4H MA and jumped from that level. Short term trend biased higher and minor weakness can be seen only below 1.19700.

- On the lower side, near term intraday support is around 1.1990 (20 4H MA) and any break below will drag the pair down till 1.1970/1.19580/1.19298 (yesterday low)/1.18680.

- The near term resistance is at 1.2100 and any break above will take the pair till 1.2200.

It is good to buy on dips around 1.19900 with SL around 1.1930 for the TP of 1.20925/1.2200.