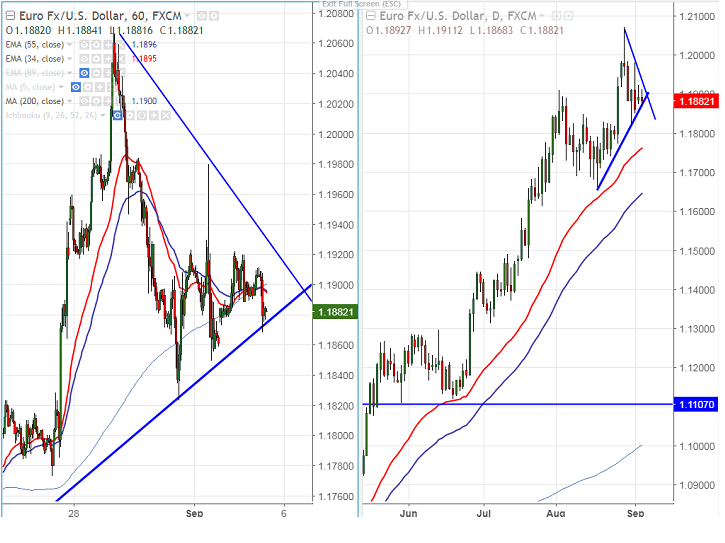

- EUR/USD declined once again after showing a minor jump till 1.19221 yesterday. The pair is waiting for ECB meeting which is to be held on Sep 7th for further direction. It is currently trading around 1.18795.

- On the lower side, near term intraday support is around 1.1875 (trend line joining 1.16816 and 1.18440) and any break below will drag the pair down till 1.18230 (Aug 31st low)/1.17750.

- The near term resistance is at 1.19230 high made yesterday and any break above will take the pair till 1.19795 high made after U.S Nonfarm payroll/1.200/1.2070 (Aug 29th 2017 high).

It is good to sell below 1.18750 with SL around 1.1930 for the TP of 1.18230/1.1780.