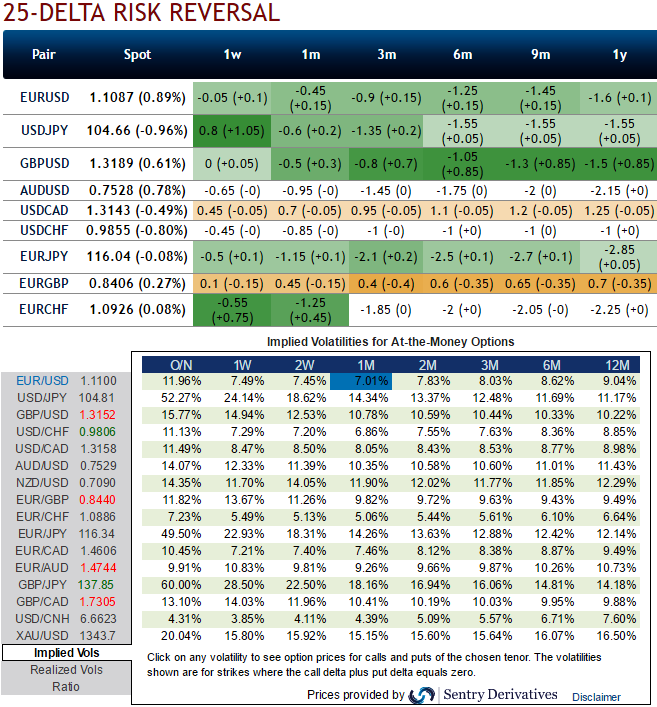

The delta risk reversals with positive changes of all time frames have alerted the major non-directional trend that has lasted since February 2015 but gradually favours downside hedging risks over the longer period of time, but in the short run, it has been bullish neutral.

While current IVs of 1W ATM contracts of EURUSD are crawling reluctantly a tad below 7%, a massive drop from recent times, as a result option premiums likely to shrink away on account of time decay.

USD risk-reversals should be pressured further to align with the impulsive retracement in spot.

Since from almost last one year, we've been seeing the pair oscillating within stiff sideway trend (ranging 1.1480 to 1.05 levels).

Derivatives strategy for non-directional EURUSD:

Since the EURUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs and neutral risk reversal sentiments, accordingly we construct a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

EURUSD’s non-directional pattern is persisting from last one year or so, but some bullish neutral indications are observed, slight bearish pressures can be seen in the days come, hence, we prefer this strategy there is a massive collapse in implied volatility.

The trader can construct a long condor option spread as follows,

The trader can implement this strategy using call options with similar maturities.

The strategy goes this way, writing an In-The-Money call and buying deep striking in-the-money call, writing a higher strike OTM calls and buying another deep striking out-of-the-money call for a net debit, all strikes should have similar tenors.

Risk reward profile:

Maximum returns for this strategy is attained when the spot FX of EURUSD drops between the 2 middle strikes at expiration. It can be derived that the maximum profit is equal to the difference in an exercise price of the 2 lower striking calls less the initial debit taken to enter the trade.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges