EURUSD (1Q’2020 1.12, 4Q’2020 1.14): The forecast envisages a belated lessening in cyclical headwinds that should enable a modest EUR recovery in line with the pull from cheap valuation and its record balance of payments support. Notably, EUR’s basic balance surplus has increased to 5.7% of GDP versus modest deficits in the US and Japan, helped by foreign inflows to Euro area equities in recent months. This underlying surplus should cushion the EUR against further cyclical disappointment and leverage it to genuine reflation.

FX Options Market Positioning:

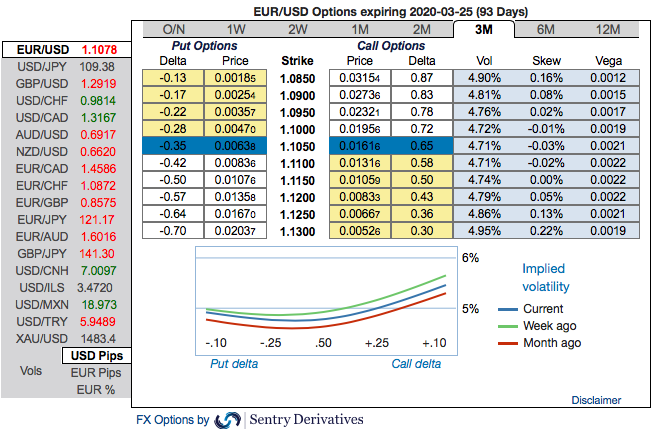

The option market concurs with this asymmetry to judge from the positive EURUSD skew and so is the case with the risk reversal numbers. But skews are stretched towards both OTM puts and OTM calls. The EURUSD projection is rolled to 1.14 for end 2020, one cent upgrade to account for the lessening in cyclical tail risks and to reflect some hint of a US political risk premium in election year. But while EUR’s structural factors are compelling, they won’t fully compensate the currency should the economy continue to underwhelm. A meaningful EUR recovery requires economic reflation, evidence for which is so far inadequate to yet justify paying still hefty negative carry to own EUR outright.

EURUSD low IVs persisted despite the US Fed and ECB monetary policies in the recent past.

Anyone wanting to hedge against medium term exchange rate fluctuations will have to think twice whether writing options might not be the better strategy rather than buying options. Those who think so, the fear that the FX market will not develop the momentum ahead of Christmas to decide for one direction or the other.

Otherwise, 3M EURUSD IVs would hardly be stuck around the 4-5% mark and it has been prolonged. If one ignores GBP volatility though the FX market has returned to the vol lows seen last summer. The hopes are lingering that the vol levels seen at the time would be short-lived was correct in the sense that volatilities rose significantly in August.

However, there is no sustainable escape from the structural low volatility environment - that much has become clear. That is seemingly positive for all those for whom FX is an undesirable risk. IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Fiscal and Monetary Policy Impact:

Fiscal policy should turn supportive for EURUSD in 2020, not so much from a loosening in Euro area policy (this will add maybe 0.2- ppt to growth), but instead the end of Trump's Keynesian boom. While Monetary policy by contrast offers little respite from record-low vol in EURUSD but on balance should be supportive for spot. The Fed is tentatively on hold but biased to ease again whereas Lagarde’s ECB may be more cautious in expanding QE and exploring the ELB.

The overall risk bias is positive reflecting EUR’s strong structural fundamentals and US political risk

Hedging Strategies: Contemplating above factors, initiated long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an (1%) out of the money put option of 2w tenors, (spot reference: 1.1063 level). Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who are sceptic about mild rallies, 3m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Those who want to participate in the prevailing rallies in the short run, one can freshly initiate the strategy. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentrix & Saxobank

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence