EURUSD underlying movements:EURUSD is extending the sharp reversal from 1.1800-1.1850 range high resistance. Focus, for now, is on whether support in the 1.1525-1.1450 can hold this decline for at least a recovery back towards 1.1650, if not another re-test of 1.1800-1.1850. Failure to hold this support sees 1.1405-1.1390 as final support ahead of the 1.1300 previous reaction lows.

We have been looking for a corrective range to expand up to 1.20-1.21 levels in the intermediate trend, before testing 1.12-1.10 support. The risk is that 1.1850 actually defines the top of that range.

On a broader perspective, we still believe 1.0350 was a major low. As such price action under 1.2600 is viewed as corrective, but ongoing with the risk of a move back to the 1.12-1.10 region, before developing a higher low.

The euro remains under pressure amid concerns about the Italian budget. Italian bond yields rose to their highest level in four years after EU commission head Juncker warned of the danger of Greek-style crisis. Reports suggest that the Italian budget will be discussed by the EU parliament on 15thof this October.

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 1m tenors signify the hedging interest of bearish risks.

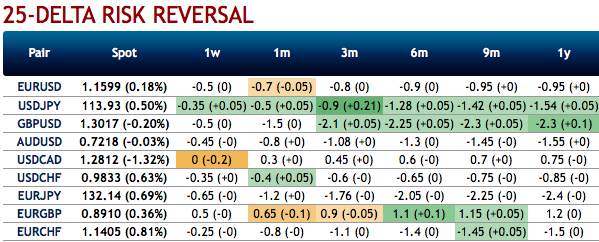

While Risk Reversal numbers of 1m tenor indicate mounting downside risks, while bearish risk sentiment remains intact in the long-run (refer long-term risk reversal numbers).

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1w at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside. Courtesy: Lloyds bank

Currency Strength Index:FxWirePro's hourly EUR spot index is inching towards -129 levels (which is bearish), while USD is flashing at 113 (which is bullish), while articulating at (09:42 GMT). For more details on the index, please refer below weblink:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes