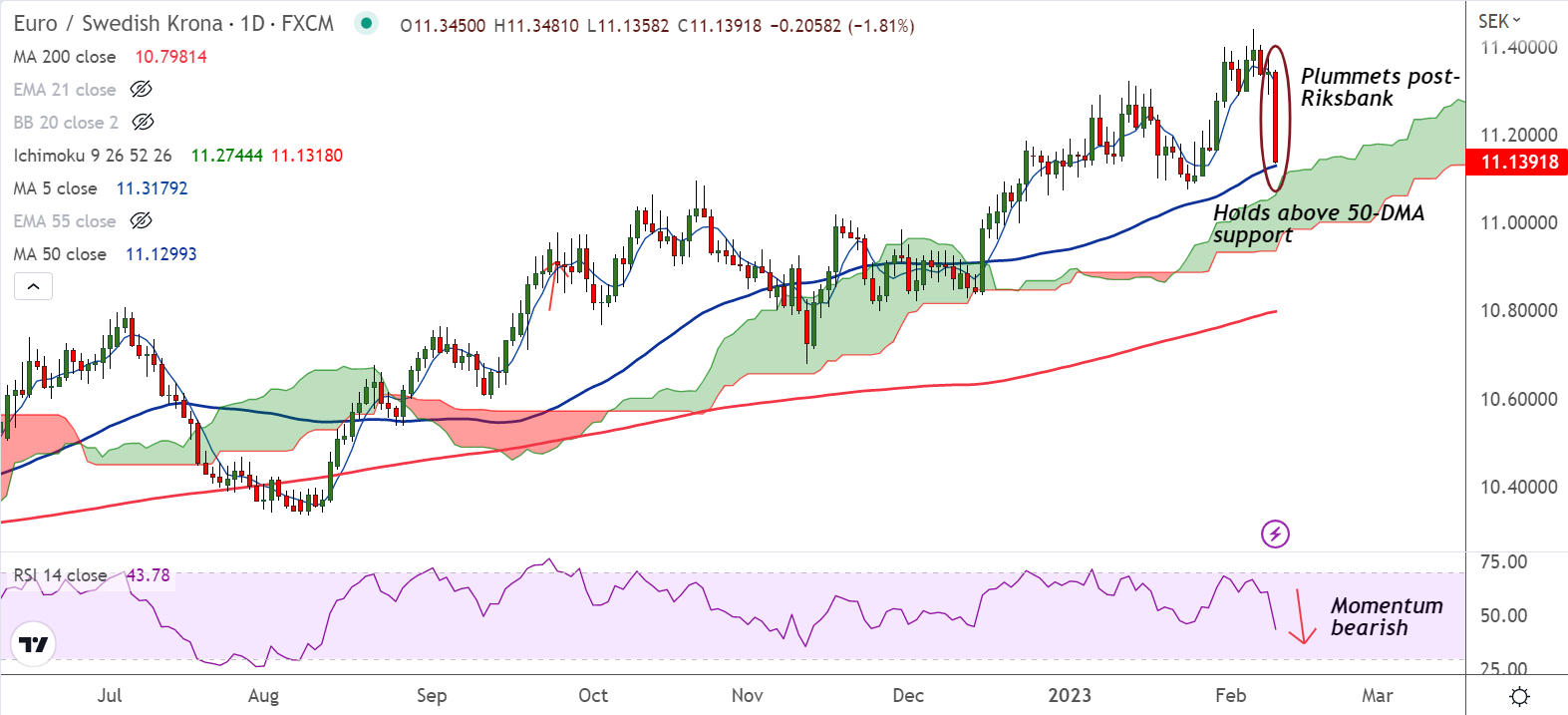

Chart - Courtesy Trading View

EUR/SEK plummets to multi-day lows after a hawkish Riksbank policy decision. The pair was trading 1.84% lower on the day at 11.13 at around 13:30 GMT.

The Scandinavian central bank raised the policy rate by half percentage point at its meeting on Thursday, broadly in line with market expectations.

The Riksbank justified the rate hike on the still elevated inflation in Sweden, the statement suggested further rate hikes at some point in the spring.

Further, the central bank announced that it will sell government bonds to reduce its asset holdings from April.

The bank's updated forecasts show the headline CPI at 8.6% in 2023 (from 9.3%) and 3.6% in 2024 (from 3.0%), and the GDP at 5.5% this year (from 5.7%) and 1.9% in 2024 (from 1.5%).

Major trend in the pair has been bullish. A bearish engulfing pattern developing on the weekly candle after today's rout raises scope for more weakness.

The pair hovers around 50-DMA support. Break below finds strong support at daily cloud. Breach below cloud could see major downside.