In 2016 we recommended a series of defensive trades into the Brexit and US election votes1 because we felt that political risks were underestimated. Going into the French elections we believe it is hard to say that political risk is still grossly underpriced, but we nevertheless highlight a set of attractive trades.

So, in outright trades, we enter a new EURPLN 2m call to position for underpriced European political risks. EURILS put spreads are probably expired in the money, and do not roll the bullish ILS exposure given expensive valuations. We encourage shorts in EURCZK forwards given the JPM’s GBI-EM inclusion.

Trade recommendations:

Long 06-May-17 EURPLN call (4.32), spot ref: 4.3150.

Long 24-Mar-17 1x1 USDRUB call spread (57.25, 61.0), spot ref: 58.0325.

Short 27-Nov-17 EURCZK forward.

Enter a new EURPLN 2m call (4.32), spot ref: 4.3150. The above chart reflects in 1-month implied volatility with a forward start of 15 April (i.e. just before the commencement of French presidential elections) for a number of currency pairs.

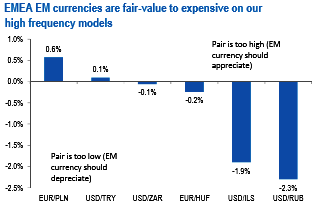

While G7 currency pairs, including EURUSD, EURJPY, and EURCHF have been moving higher in anticipation of French election risks, EURPLN and EURHUF implied volatility has been grinding lower. We think it is, therefore, attractive to buy EURPLN call options at current levels, as CEE is vulnerable to contagion from political anxiety in Europe. EURPLN is close to fair value on the valuation models, and we think the zloty will struggle to rally from current levels.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts