• EUR/NZD was little changed on Monday after euro zone inflation came in as expected in February.

• Euro zone inflation increased as expected at an annual rate of 2.6% in February and 0.6% on a monthly basis, keeping views unchanged on the timing of the first rate cut by the ECB.

• EUR/NZD has seen a 1.7855-1.7891 range on Wednesday, It was last trading at 1.7871.

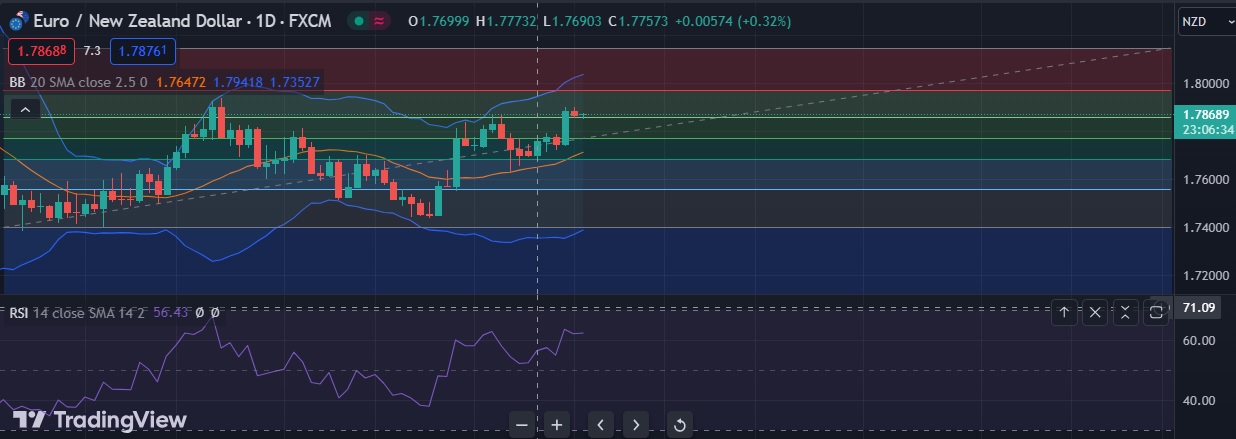

• From a technical viewpoint, RSI is strongly bullish at 62, daily momentum studies, 5, 10 and 21 daily MAs all climb.

• Immediate resistance is located at 1.7900 (Daily high), any close above will push the pair towards 1.7969 (23.6%fib).

• Immediate support is seen at 1.7859 (38.2% fib) and break below could take the pair towards 1.7763 (50% fib).

Recommendation: Good to buy on dips around 1.7850, with stop loss of 1.7780 and target price of 1.7950.