• EUR/NZD initially gained but gave up some ground after China Caixin services PMI disappointed and euro zone PMI added pressure to the reduced global growth outlook.

• EUR/NZD as traders returned from the Labor Day holiday after China Caixin services PMI disappointed and euro zone PMI added pressure to the reduced global growth outlook.

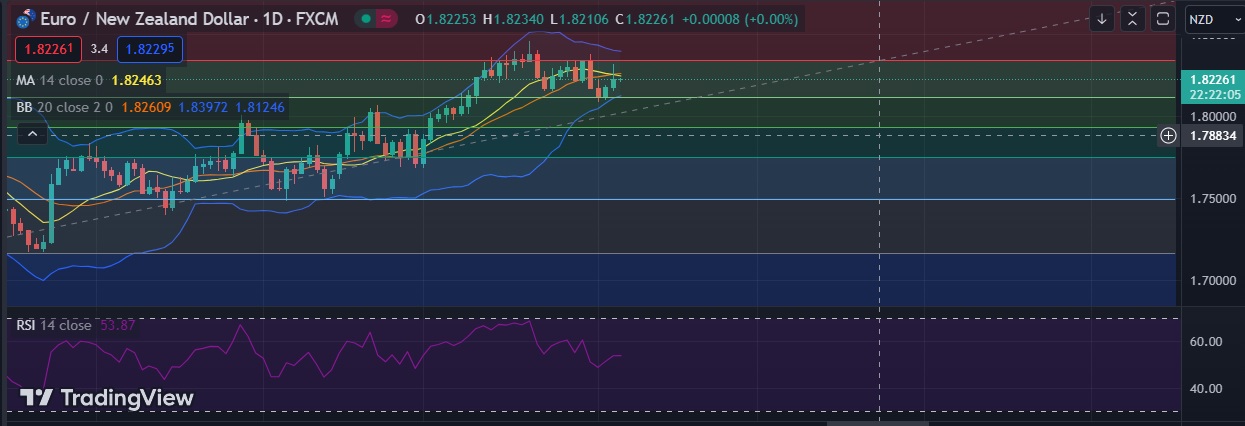

• The pair is currently approaching resistance at 14DMA. A break and daily close above will accelerate further gains towards 1.8350 level.

• Technicals highlight upside risks. The 5, 9 and 11 y above 5DMAar weakned aguisnt euro aandday moving averages lend support, daily RSI is bullish at 55.

• Immediate resistance is located at 1.8254(14DMA), any close above will push the pair towards 1.8354(23.6%fib)

• Immediate support is seen at 1.8112 (38.2%fib ) and break below could take the pair towards 1.8000(Aug 9th low).

Recommendation: Good to buy around 1.8210, with stop loss of 1.8120 and target price of 1.8320