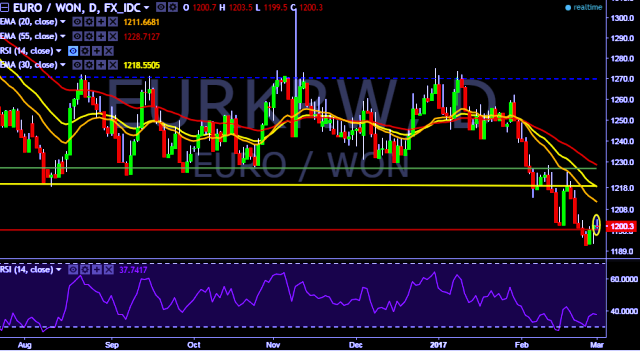

- EUR/KRW is currently trading around 1,202 mark.

- Pair made intraday high at 1,203 and low at 1,199 levels.

- Intraday bias remains neutral till the time pair holds key support at 1,199 mark.

- A daily close below 1,199 will drag the parity down towards key supports around 1,191, 1,184, 1,178 and 1,163 marks respectively.

- Alternatively, a sustained close above 1,199 will take the parity higher towards key resistances around 1,205, 1,221, 1,233, 1,242, 1,252, 1,268, 1,272, 1,280, 1,287 and 1,304 marks respectively.

- South Korea’s February trade balance prelim increase to 7.22 bln $ vs previous 2.80 bln $.

- South Korea’s February export growth prelim increase to 20.2 % (forecast 14.7 %) vs previous 11.2 %.

- South Korea’s February import growth prelim increase to 23.3 % (forecast 21.7 %) vs previous 19.7 %.

We prefer to take short position in EUR/KRW only below 1,199, stop loss at 1,205 and target of 1,184.