The Swiss franc, Norwegian and Swedish Kroner have all suffered slightly this week from French political concerns, Euro has not been an exception.

French opinion polls and Presidential politics generally are now moving markets in Europe. The bookmakers’ odds of Marine Le Pen winning rose at the start of the week so that the main candidates were level-pegging close to 33%, which triggered selling for the Euro and for French bonds.

The flash Eurozone PMI was the highest since 2011; use any abrupt spikes in the underlying spot of FX of euro crosses; euro and oil have decent downside on a Le Pen victory: euro could fall about 10 cents (10%) to about 0.98 over a few weeks and oil could decline by 5-10%.

In the remote scenario of a Le Pen Presidency with supportive government and Parliament, 10Y Bunds could approach 0bp and 10Y France-Germany 200bp, with sharply wider Bund swap spreads (54bp), FRA/OIS (20bp) and EURUSD cross currency basis (-60bp), and higher volatility (Bund implied 6bp/day).

Sensitivity tools for improving odds in hedging framework:

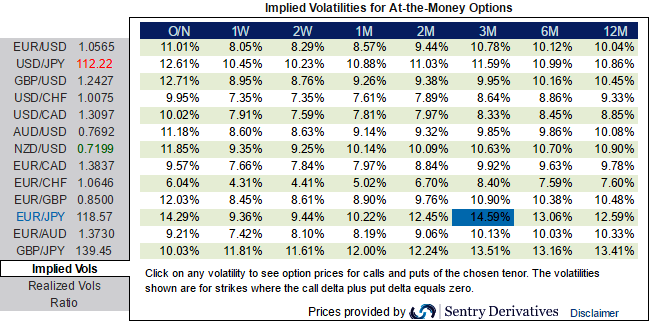

For now, please be noted that the OTC indications of 1-3m combinations are the most conducive for the construction of put ratio back spreads.

We’ve already highlighted in our recent write ups on richness in EURJPY skews.

The EURJPY volatility surface is currently offering very attractive adding long opportunities 1m/3m put ratio back spreads, as ATM volatility is rich and 1m/3m IVs are positively skewed. Here, we recommend a couple of trades taking advantage of both the volatility and skew premiums.

The 3m risks reversals are bidding for higher prices in underlying EURJPY spot FX with downside risks in long run (3m RR highest among G10 space). 1m IVs are shrinking away while 3m IVs rising, we interpret this as the options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy.

So entering the position when implied volatility is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

Hence, one could write 1m ITM put options, while adding longs in 3m ATM or OTM put options simultaneously.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close