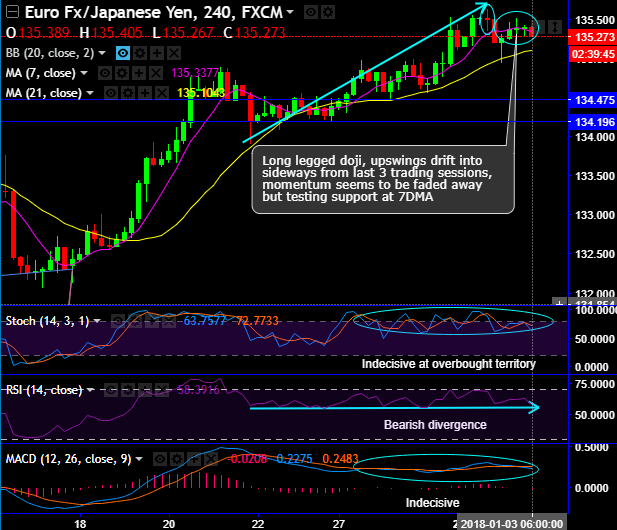

Chart and candlestick pattern formed- Bearish RSI divergence, the sideways trend followed by long-legged doji on intraday terms and Consolidation phase breaches 61.8% Fibonacci retracements, shooting stars appear at stiff resistance one on monthly plotting.

Ever since the long-legged doji occurs at 135.493 and 135.376 levels, the trend has been drifting in sideways (refer 4H chart). Consequently, these bearish patterns signal weakness as the leading oscillators indicate overbought pressures.

One can easily make out the RSI evidences the bearish divergence to the price rallies so far, while fast stochastic curves pop up with %D crossover to signal intensified selling momentum.

The major supports are observed at 135.100, 134.475 and 134.196 levels, we don’t think that the bears will be able to break below these levels in this week’s trading sessions because the trend indicators have still been favorable to the bullish side.

Momentum oscillators on both timeframes have been indecisive but pop up overbought pressures, whereas the trend indicators are bulls' favor.

Momentum study: In the short run, as both leading oscillators (RSI signaling bearish divergence & stochastic curves show %D crossover) are slightly indecisive for further buying sentiments but evidence overbought pressures, thus the strength and the momentum in prevailing buying interests seem to be quite dubious. While same has been the case in monthly terms.

Trend indicators: MACD on weekly terms has been showing bullish crossover to indicate upswings to prolong further.

Trade tips: On trading perspective, it is advisable to buy boundary binaries using upper strikes at 135.534 and lower strikes at 135.100 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains between these two strikes before the binary expiry duration.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 12 levels (which is neutral), while hourly JPY spot index was at 9 (neutral) while articulating at 07:46 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

The above indices are also conducive to our binary options strategy.

FxWirePro launches Absolute Return Managed Program. For more details, visit: