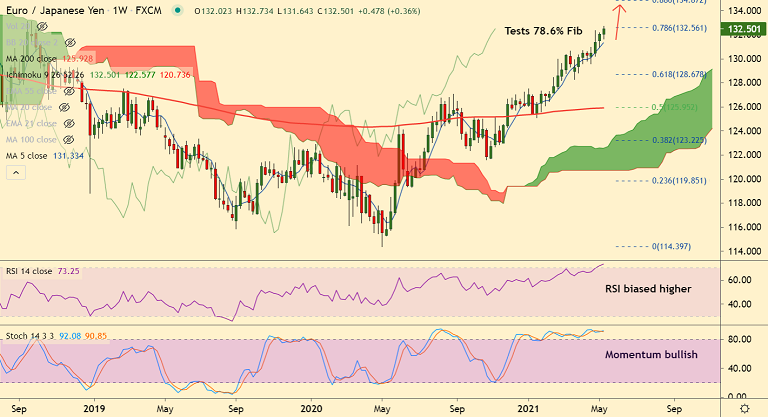

EUR/JPY chart - Trading View

EUR/JPY was trading 0.24% higher on the day at 132.50 at around 11:15 GMT.

The pair is extending bull run for the 7th straight month. A break above 200-month MA has opened upside for the pair.

Price action has tested 78.6% Fib retracement at 132.56, momentum with the bulls.

GMMA indicator shows major and minor trend are strongly bullish on the daily and weekly charts.

MACD and ADX supports gains. Price action has edged above monthly cloud and Chikou span is biased higher.

The pair is on track to test 88.6% Fib at 134.87. Failure to hold above 200-month MA negates further upside.