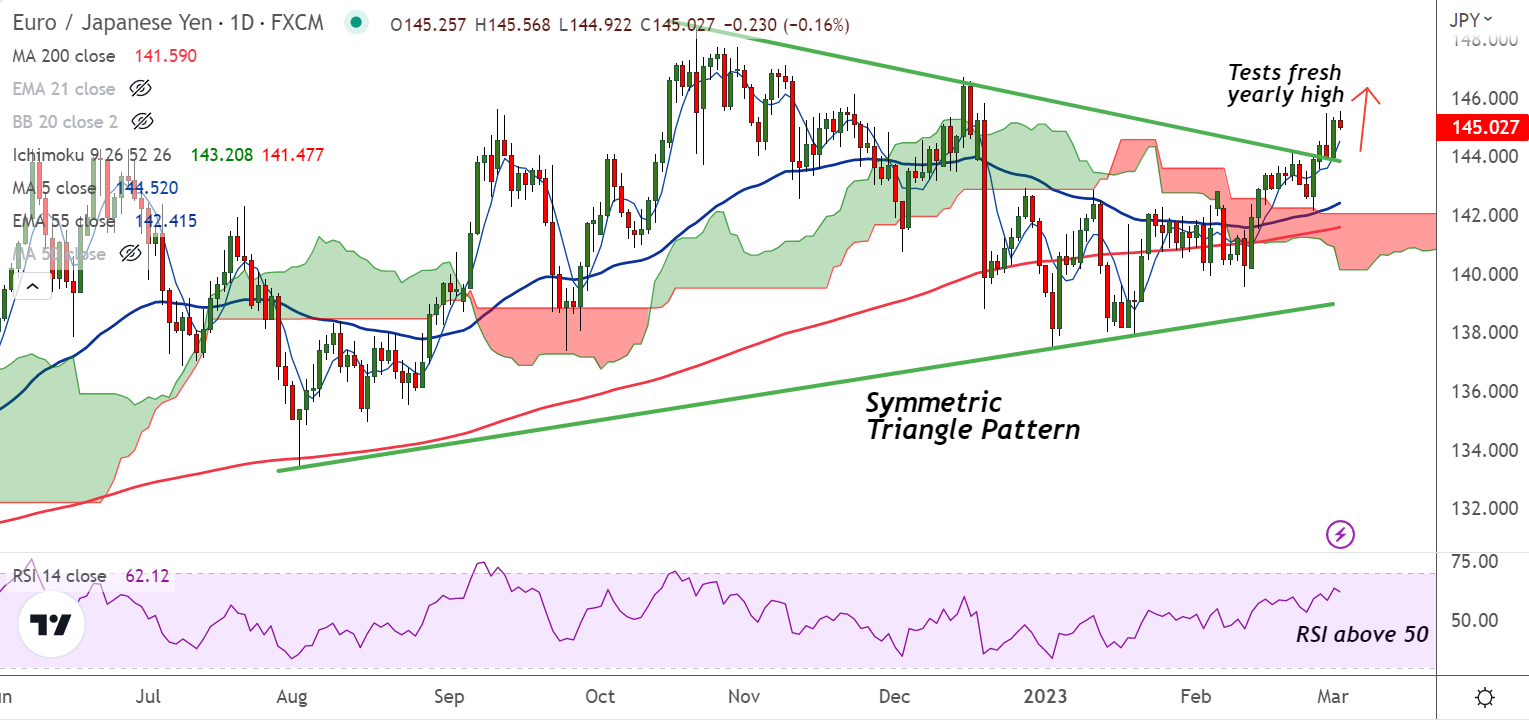

Chart - Courtesy Trading View

EUR/JPY was trading 0.13% lower on the day at 145.06 at around 10:10 GMT, down from session highs at 145.56.

The common currency comes under pressure after EMU Flash inflation figures surprised to the upside in February.

Data published by Eurostat showed on Thursday annualized Eurozone Harmonised Index of Consumer Prices (HICP) slipped to 8.5% in February from January’s 8.6%, above 8.2% expected.

The core HICP rose to 5.6% YoY in February also above 5.3% expected and 5.3% seen in the January reading.

On a monthly basis, Eurozone HICP unexpectedly jumped to 0.8% in February vs. -0.3% expected and -0.2% previous.

The core HICP arrived at 0.8% in the said month as against the 0% expected and -0.8% registered in January.

Market price in a 65% probability of a 50bp hike in May, with a 50 bps March rate hike almost a done deal, as endorsed by several ECB policymakers.

Support levels:

S1: 144.53 (5-DMA)

S2: 143.83 (200H MA)

Resistance levels:

R1: 145.63 (Upper BB)

R2: 146.36 (Dec 2022 high)

Summary: EUR/JPY trades with a bullish bias. GMMA indicator shows major and minor trend are bullish. Momentum is bullish and volatility is high and rising. Breakout of Symmetric Triangle pattern has raised scope for further upside.